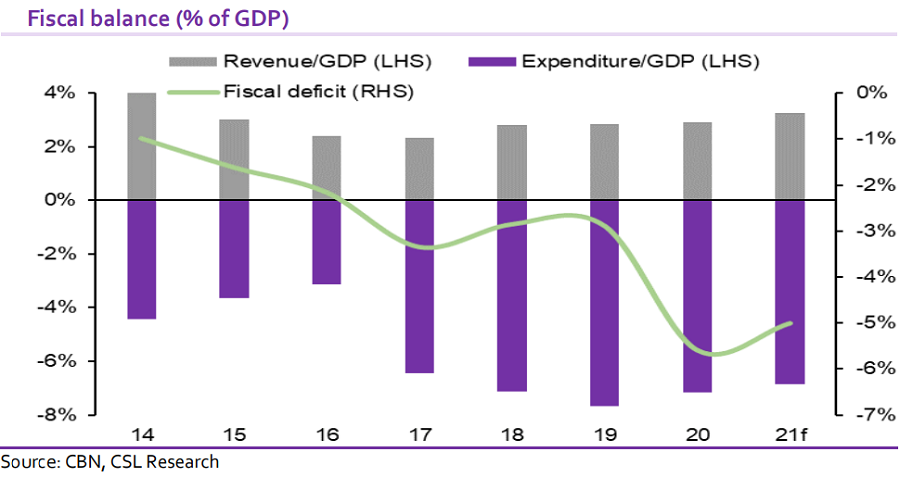

The 2022-2024 Medium Term Expenditure Framework Fiscal Strategy document showed that government revenue from January to May 2021 was N1.8 trillion, a 33.3% shortfall of the budgeted amount. This indicates that the recent rise in crude oil prices (+46.4% YTD) has not improved the government’s fiscal position. We note that the OPEC+ agreement continues to place a cap on oil earnings, as crude oil production (excluding condensate) was 1.4mb/d in Q1.

As such, oil revenue was 48.4% lower than budgeted in the same period under review. In line with our view at the start of the year, recovery in economic activities supported the non-oil revenue, with the government missing its target slightly by 0.26%. This was driven by both VAT and CIT, which outperformed the budget by 24.7% and 2.4%, respectively.

On the expenditure front, the budget implementation rate between January to May 2021 was 85.8%, with the shortfall emanating from CAPEX. Specifically, CAPEX was 43.1% lower than budgeted, as the government continues to increase recurrent expenditure. On a worrisome note, total debt servicing (N1.80 trillion) was 30.1% higher than budgeted. This was mainly driven by the interest payment on ways and means (government facility from the CBN), which settled at N480.52 billion (26.0% of the revenue). Consequently, the total debt servicing to revenue ratio came to 97.7% for the review period.

Over the second half of the year, we expect the oil revenue to improve, supported by increasing crude oil prices and improved crude oil production as OPEC production cuts reduce. Overall, we expect the fiscal deficit to print at 5% of GDP in 2021. Furthermore, Nigeria currently pays about N140 billion per month as fuel subsidy, which translates to about N1.7 trillion yearly. As such, if crude oil prices continue to soar, we expect fuel subsidy to total

revenue to settle at 30% by year-end.

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.

nice development i love it

This is really a great one & i really love the development

Great development, we need more of this

ITS OBVIOUS BUT THATS WHAT MY COUNTRY IS GOOD AT

I love this new development