Companies oftentimes undergo changes in ownership by way of consolidation or mergers and acquisition. The Nigerian mutual fund industry, unlike the banking industry, has not witnessed any noticeable mergers, acquisitions or consolidations so far, however, the industry from time to time sees some funds being transferred from one mutual fund company to the other. Three of such transfers happened recently.

- Management of ACAP Canary Growth fund and ACAP Income Fund has now been transferred to GDL Asset Management Company

According to information from the Security and Exchange Commission (SEC), “the Management of ACAP Income Fund and ACAP Canary Growth Fund has been changed from Alternative Capital Partners Ltd (ACAP) to GDL Asset Management Ltd. The transfer process has just been concluded.” By that action, ACAP Income Fund and ACAP Canary Growth Fund have been renamed as GDL Income Fund and GDL Canary Growth Fund respectively.

That being said, Alternative Capital Partners Limited has dropped out as a fund manager on the SEC weekly NAV Summary report. It is not yet clear if Alternative Capital Partners Limited will continue to exist as a fund manager or not, however, a visit to the website has an indication of business as usual although the last price for the Canary Growth Fund displaced on the website was for March 30th, 2021.

Déjà vu

It would be recalled that ACAP Canary Growth Fund was the product of the consolidation of the acquisition of the management interest/transfer of the fund management role of Oceanic Vintage fund from Oceanic Bank Capital and the acquisition of the fund management interest and role in Intercontinental Integrity fund from Intercontinental Capital Market limited by Alternative Capital Partners Limited.

So, the Oceanic Vintage fund and Intercontinental Integrity fund were combined to form ACAP Canary Growth fund.

- Management of UPDC Real Estate Investment has now been transferred to Stanbic IBTC Asset Management Company

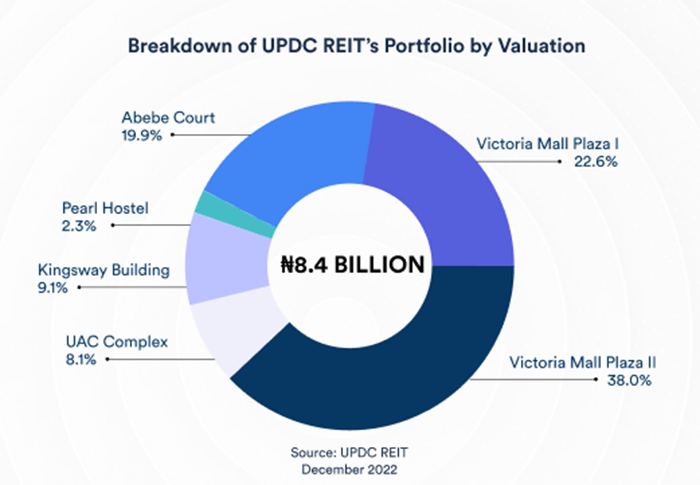

In another development, the Security and Exchange Commission has noted that “the management of UPDC REIT has been changed from FSDH Asset Management Ltd to Stanbic IBTC Asset Management Ltd.” At press time, the UPDC REIT has not been renamed and one would not be surprised if it becomes Stanbic IBTC Real Estate Investment Trust Fund.

Confirmation:

In an email exchange, representatives of both Stanbic IBTC and Alternative Capital Partners Limited confirmed the change in management role. Stanbic IBTC in their response noted as follows, “Yes, Stanbic IBTC Asset Management Limited has recently been appointed the Fund Manager to the UPDC REIT” while Alternative Capital Partners Limited stated that “the Fund Management role has been transferred from Alternative Capital Partners Ltd to GDL Asset Management Ltd.” According to the response from Stanbic IBTC, the change in managerial role seems to be by appointment but it was not clear if the appointment was by the regulatory authorities or by a consensus of the unit holders.

What this means for you (as an investor)

The intuitive implication of the above is that the affected funds are now being managed by new fund managers. Investors should pay attention to any fund documents or releases or fact sheets coming from the new managers to find out if the fund objective and investment strategy remain the same. If not, then investors should find out if the new objective and strategy agrees or aligns with their (the investors’) investment objectives or not. If there is no change in objective and strategy, then investors should wait it out and see if there will be an improvement in fund performance as a result of new management.

Investors should also find out if the expense ratio of the funds will or has changed. If the fund expenses increase, with no change in objective and strategy, it may be time to think of changing or switching to another fund. Again, there may be a need to wait it out for a couple of months to see if the change in expenses is being compensated with improved performance.

If there is no change in expenses, or if expenses decrease, then investors will have a good reason to stay put.

Though it is often stated that past performance is not a guarantee of future performance, investors should review the historical performance of funds being managed by the new fund managers (GDL and Stanbic IBTC in this instance) in comparison with the performance of the funds prior to the change in managerial role. Such comparative analysis will give an idea of what the performance of the funds may be under a new asset management company.

We do not have access to the details of the transfer as to know what options unit holders have in the transfer, whether they are required to remain in the funds or are free to withdraw their unit interests. One would expect that investors should be given such options, however.

I bought this share with intercontinental bank, that is intercontinental integrity fund.but I only received two dividend from them . what is happening please