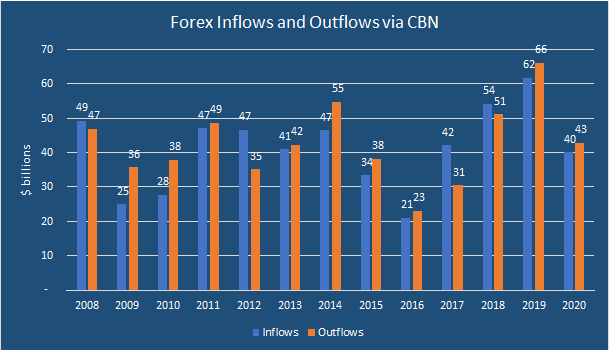

A total of $43 billion in foreign currency flowed through Nigeria’s central bank as outflows in the whole of 2020, latest data from the Apex bank shows. This compares to the $66 billion in foreign currency outflows via the CBN in 2019.

The CBN received a total foreign currency inflow of $40 billion during the year compared to $62 billion a year earlier. The Central Bank of Nigeria has recorded a deficit or a net foreign currency outflow of $3 billion in 2020 (2019: $4 billion).

Nigeria faced an excruciating foreign currency crisis in 2020 as the fall in oil prices, global lockdown due to Covid-19 and a dearth in capital importation affected Nigeria’s foreign currency balances forcing multiple devaluations during the year and a wide disparity between the official and parallel market exchange rate.

Dip in oil and non-oil dollars

In prior years, the central bank has had to rely on oil dollars, non-oil imports and capital importation to boost the country’s foreign currency balances. However, all three major sources recorded massive drops as covid-19 raged on and foreign investors stayed away. For example, foreign currency inflow from oil revenues in 2019 was $15.8 billion compared to $10.5 billion in 2020. Non-oil forex inflows also went from $40.8 billion in 2019 to $29.6 billion in 2020.

But while inflows to the CBN fell in 2020, the bank still had to disburse all it had in foreign currency outflows to other obligations such as sale to BDCs, sales on the I&E window, sale to importers as well as funding other government obligations.

Perhaps in one of the strongest explanations for the exchange rate disparity between the naira and dollar, BDC operators received a total of $5.3 billion in sales from the CBN during the year compared to $13.6 billion in 2019. In fact, in 2020, the apex bank suspended the sale of forex to BDCs between the months of April and August.

On the other hand, the Investor and Exporter Window received only $2.6 billion in sales from the CBN compared to $5.9 billion a year earlier. Just like the BDCs, no sale was made to this window between February and July 2020. The CBN however, maintained sale in the SMIS window pushing out about $6.8 billion during the year.

Two major inflows which passed through the CBN were the IMF facility of $3.35 billion in April 2020 and the World Bank facility of $2 billion in December.

Dip autonomous sources

During the year, Nigeria also recorded lower inflows from forex from autonomous or independent sources such as non-oil exports, capital inflows and invisibles. Forex from autonomous sources is a reliable source of hard currency for the Nigerian economy as it complements the central bank in funding demand for forex.

However, foreign exchange flows through autonomous sources were $75 billion in 2020 compared to $85 billion in 2019. One of the reasons for the drop was the amount in domiciliary accounts of Nigerians, a major source of forex liquidity for banks. During the year only $23 billion came through that source compared to $30 billion a year earlier. This can be attributed to the several forex restrictions imposed by the CBN dissuading Nigerians from depositing cash forex into their accounts. There were also concerns that depositing forex even via wired sources may attract further restrictions on withdrawals.

Home remittances, a major source of forex inflow from the CBN also fell from $3.2 billion in 2019 to just $1.2 billion. This, perhaps, triggered the central bank’s cash 4-dollar scheme which has now been extended indefinitely. The cash 4-dollar scheme targets Nigerians in diaspora looking to remit forex to their loved ones locally.

During periods of forex crisis, remittances through official channels like the central bank are often jettisoned by Nigerians due to foreign exchange restrictions and the policy of having to withdraw it in dollars. In 2016 for example, when Nigeria faced a similar forex crisis, home remittances fell to about $420.8 million.

However, this year, as part of its Naira 4-dollar scheme, the apex bank now allows Nigerians to withdraw their remittances in hard currencies, which they can then go and sell at the black market. The purpose was to help improve liquidity at the retail end of the black market, however, this has not materialized as the exchanged rate depreciated further to N495/$1.

There is also no official data showing how the naira4dollar scheme has performed since it was introduced in March.