Fears at the Crypto market got intensified in the early hours of Wednesday when Bitcoin dropped to as low as $39,750 with record profit-taking causing a rumble in the cryptoverse.

Market sentiments momentarily weakened as many altcoins including Bitcoin lost as much as 10%. Negative news over the past week has dampened sentiment for the flagship cryptocurrency.

READ: Nobody is going to ban Bitcoin – US Bank regulator

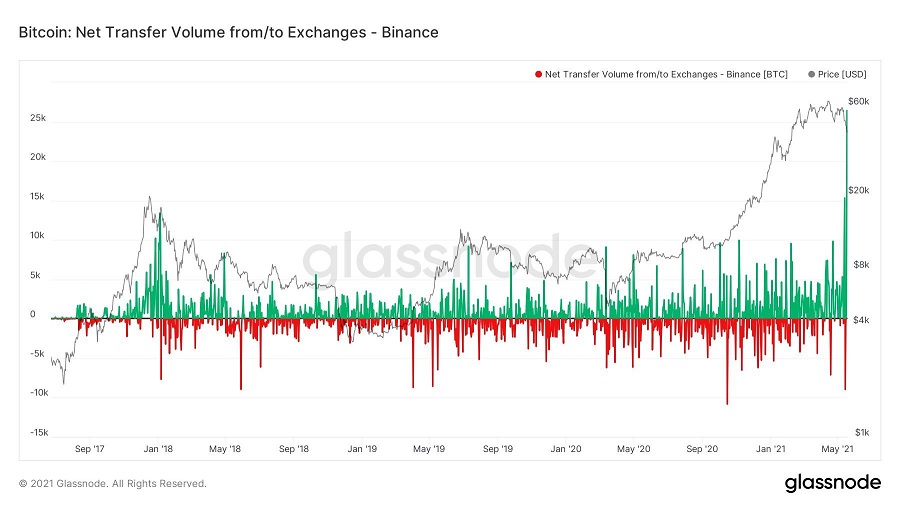

Most current data from Glassnode reveal in the past few hours, Binance the world’s largest crypto exchange recorded the highest Bitcoin inflows ever, suggesting a lot of investors are trying to curb their crypto exposure.

READ: Miners earn a whopping $3.5 million per hour on Ethereum network

READ: Bitcoin miners are outrageously rich, earn $4 million per hour

For the day, about 165,202 investors were liquidated with the largest single liquidation order on Bybit-ETH valued at $12.25 million.

At the time of drafting this report, the global crypto market cap value stood at $1.9 trillion with the market posting losses as high as $200 billion with an 8.45% plunge over for the day.

The bearish sentiments in the cryptoverse strengthened after Elon Musk reported Tesla had suspended vehicle purchases using bitcoin, citing environmental concerns, thereby giving the bears much firepower in breaking key support areas within a matter of days.

READ: Ethereum’s Vitalik Buterin: Story of a 27-year-old Crypto billionaire

Recent reports that Chinese financial regulators have warned financial institutions against involvement with cryptocurrencies added more selling pressures.

Recall that a few weeks ago, the Governor of the Bank of England, Andrew Bailey warned investors against excessive exposure to cryptocurrency investments as they have no intrinsic value, meaning that investors could lose all their funds invested in such assets.

In his words:

That doesn’t mean to say people don’t put a value on them, because they can have extrinsic value. But they have no intrinsic value. I’m going to say this very bluntly again, buy them only if you’re prepared to lose all your money.”

Market critics anticipate the crypto market was a bubble waiting to burst, as many of these digital assets have near-zero fundamentals backing them.

Market experts have long fretted that a record quantitative easing program triggered by global central banks had fuelled these digital assets to prices that defy the thinking of mainstream financial analysis, but such fears have been unable to relatively pause their bullish trend.

Nevertheless, the flagship crypto is still pretty much having a bullish run as in 2021 alone, it has posted gains of over 40% year-to-date and 320% in the past year.

Is there any hope for the market?