Wealthy investors have increased their transactional volume just as a Bitcoin whale moved about $440 million some hours ago. The world’s most popular crypto asset hovers around $54,500.

Data retrieved from Btc Blockbot revealed the wealthy entity moved 7,970 BTC worth $440 million in block 681,99.

Whale alert! ? Someone moved 7,970 BTC ($440M) in block 681,990 https://t.co/7i5oUdrpic

— Bitcoin Block Bot (@BtcBlockBot) May 5, 2021

READ: 1 Bitcoin will buy you a house in Nigeria’s rich suburb

In the past few weeks, the flagship crypto has relatively experienced a significant amount of selling pressure after touching $58, 0000 and plummeting as low as $47,000, suggesting that institutional inflow on the world’s most popular crypto asset seems to be faltering.

Adding credence to the weakening buying spree is data retrieved from Glassnode postulating that the Bitcoin number of Addresses holding 10+ Coins just reached a 4-year low of 147,046

The previous 4-year low of 147,094 was observed on 03 May 2021.

READ: Dogecoin breaks new high, far more valuable than Nigerian Stock Market

At the time of writing Bitcoin traded at $54,465.57 on the FTX exchange with a daily trading volume of about $70 billion. For the week, the flagship crypto asset is up by just 0.35% and it remains by far the most valuable crypto by market value with a valuation of $1.018 trillion.

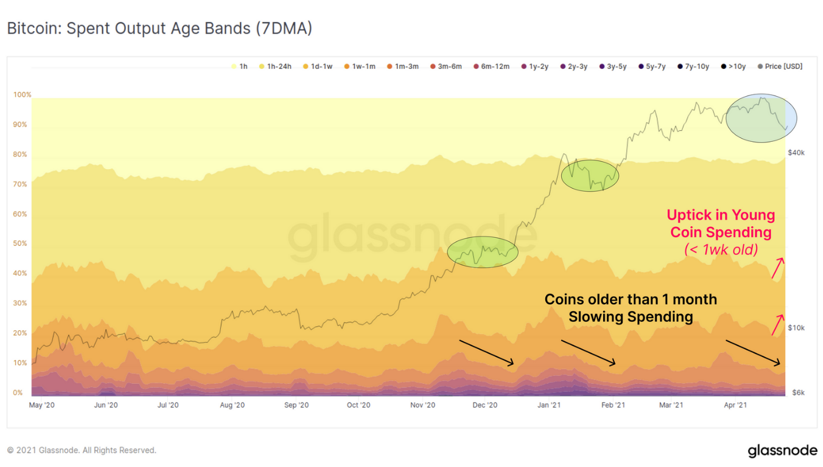

Recent data reveal Bitcoins older than 6-months have not seen a meaningful increase in spending since the correction back in February, meaning long-term holders have paused their buying actions momentarily.

Previous instances of similar spending behaviour were observed during the December 2020 consolidation, just before breaking to a new all-time high, and during the first bull market correction in January.

What you must know

At the flagship crypto market, traders or investors who hold large amounts of bitcoins are typically referred to as whales.

This means that a BTC whale would be an individual or business entity (with a single Bitcoin address) owning around 1000 Bitcoins or more.

Usually, as these whales accumulate the flagship crypto assets, Bitcoin’s circulating supply reduces, and this can weaken any bearish trend the crypto asset finds itself in.