Nigeria’s largest bank by market capitalization, GT Bank has reacted to a Nairametrics report which revealed the bank’s succession plans in the wake of the retirement of Segun Agbaje as MD/CEO of the Bank.

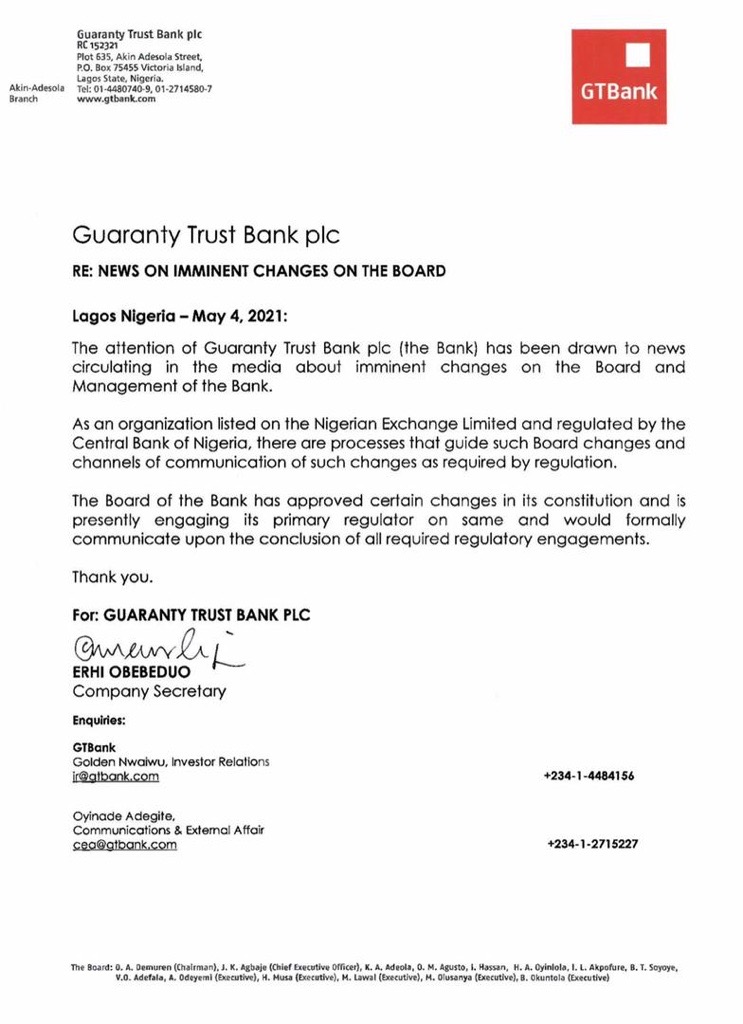

In a press release signed by Company Secretary, Erhi Obebeduo, the bank neither confirmed nor denied the report but did admit it was engaging with regulators on the matter and will communicate such officially once it obtains regulatory approvals.

See excerpt below:

“The attention of Guaranty Trust Bank plc (the Bank) has been drawn to news circulating in the media about imminent changes on the Board and Management of the Bank.

As an organization listed on the Nigerian Exchange Limited and regulated by the Central Bank of Nigeria, there are processes that guide such Board changes and channels of communication of such changes as required by regulation.

The Board of the Bank has approved certain changes in its constitution and is presently engaging its primary regulator on same and would formally communicate upon the conclusion of all required regulatory engagements.”

Banks are not allowed to make such announcements public until they obtain the approval of their regulators. Such announcements are also routed via the Nigerian Stock Exchange before being made public.

Nairametrics had reported on Monday that the bank had approved a slew of management and board changes that pave the way for new leadership at one of Nigeria’s most respected bank.

See the full press release below:

GT bank is the most useless bank ever, I sent money to my friend through a Pos merchant machine since Friday my friend had not gotten the alert…… I will sue this stupid GT to court, 2. My account has been restricted since 3 weeks ago I have been going to the bank severally but they have not resolved it… GT bank na scam those of you using it you better go and withdraw your money and use a good bank

Your mass facility loan approved for jigawa state workers is going so slow please and please change the pattern as many are planing to look for alternative