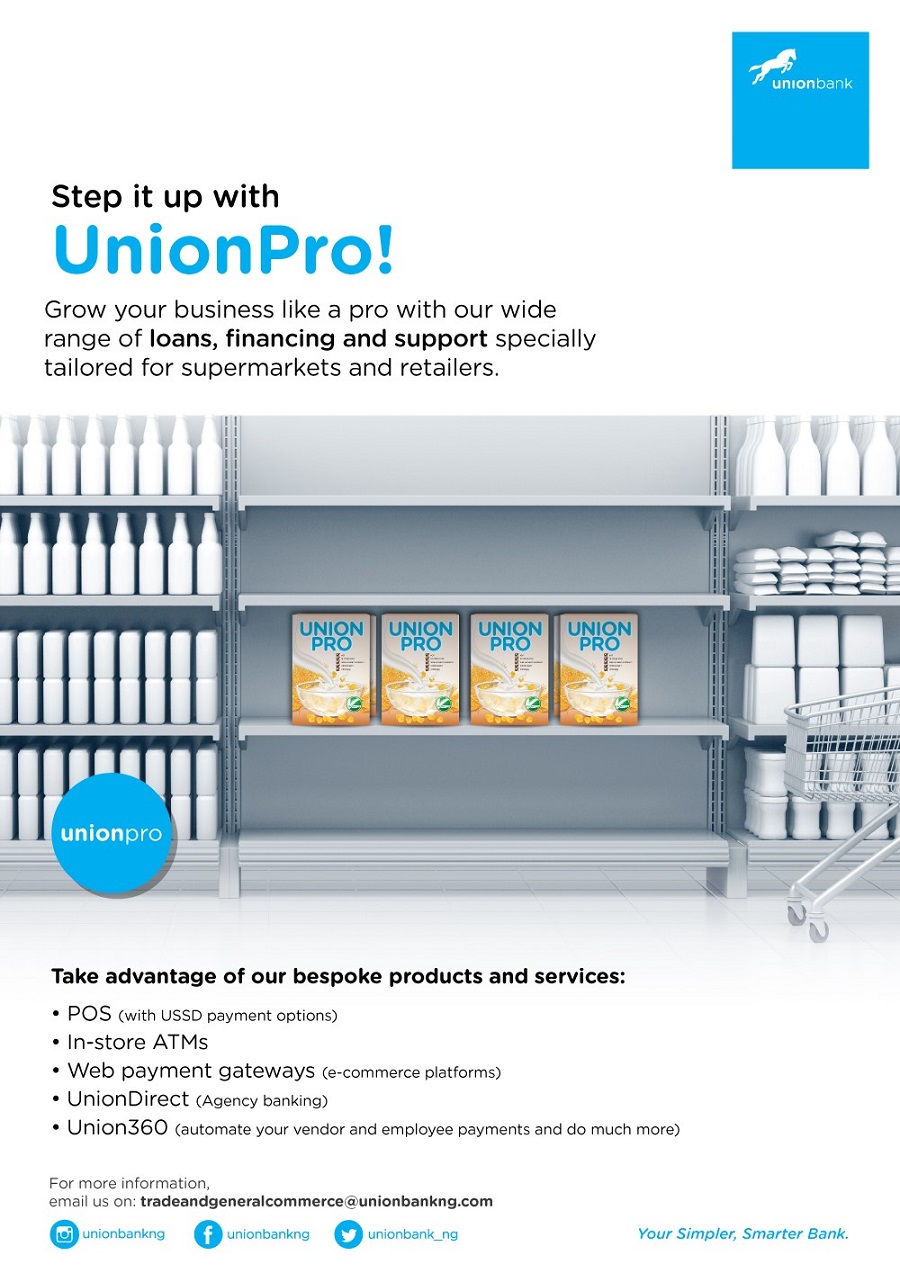

As part of efforts to boost trade and commerce in Nigeria, Union Bank has unveiled UnionPro, a proposition designed to provide tailored financial services and solutions to supermarkets and large retail chain stores.

With UnionPro, large retailers can now access a single platform offering a wide bouquet of solutions to enrich their businesses and optimise their offerings. These solutions include agency banking; point-of-sale (POS) terminals; in-store ATM deployments; web payment gateways and access to Union360 – a secure web-based solution that offers an end-to-end single point for payments and collections. The retailers can also benefit from business loans such as overdrafts, short-term finance, distributor finance and invoice discounting finance.

Through this innovative offering, Union Bank will strengthen its support for the Nigerian retail sector which continues to show promise despite harsh economic conditions. According to AT Kearney’s Global Retail Development Index (GRDI), “the long-term prospects of Nigeria’s retail sector remain positive, supported by the budding middle class, the growing popularity of the formal retail space and the rapid rise of e-commerce.”

Commenting on the launch of UnionPro, Union Bank’s Divisional Executive, Commercial Banking, Gloria Omereonye highlighted the key role of large retail stores and supermarkets in boosting the economy. She also outlined the benefits of the UnionPro proposition while reiterating the Bank’s strategic approach to developing innovative services that support its customers. She said-

“We are proud to support local businesses through tailored products and services that ease the challenges of doing business in Nigeria. With UnionPro, we are making a commitment to work closely with large retailers, providing the necessary support they require to grow and expand their businesses.”

Union Bank is a foremost financial institution in Nigeria, offering a wide range of products and services for Small and Medium-sized Enterprises (SMEs) and larger businesses. The UnionAccelerate account, a high-interest hybrid current account with zero bank charges is one account created for medium-sized businesses. The benefits of the account include zero extra charges for all Union Bank services: on-line/ real-time banking and e-banking (both Internet banking & banking via ATMs). UnionAccelerate accounts can also be used as a salary/payroll account.

Union Bank remains focused on enabling the success of its customers through innovative finance solutions and platforms.

About Union Bank Plc.

Established in 1917 and listed on the Nigerian Stock Exchange in 1971, Union Bank of Nigeria Plc. is a household name and one of Nigeria’s long-standing and most respected financial institutions. The Bank is a trusted and recognizable brand, with an extensive network of over 300 branches across Nigeria.

In late 2012, a new Board of Directors and Executive Management team were appointed to Union Bank and in 2014 the Bank began executing a transformation programme to re-establish it as a highly respected provider of quality financial services.

The Bank currently offers a variety of banking services to both individual and corporate clients including current, savings and deposit account services, funds transfer, foreign currency domiciliation, loans, overdrafts, equipment leasing and trade finance. The Bank also offers its customers convenient electronic banking channels and products including Online Banking, Mobile Banking, Debit Cards, ATMs and POS Systems.

More information can be found at: www.unionbankng.com

Media Enquiries: Email yowonubi@unionbankng.com

I am interested.