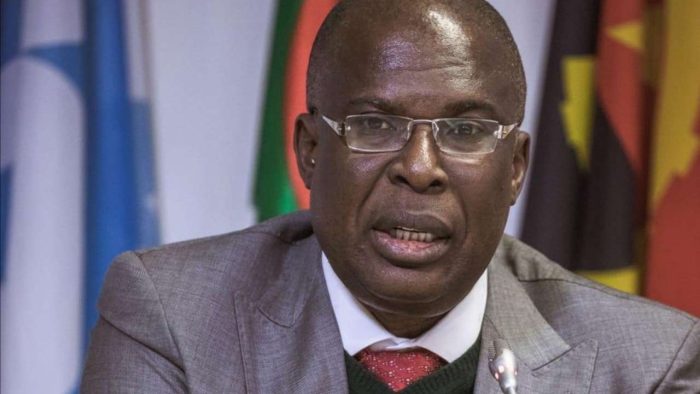

In December 2019, the Federal Government of Nigeria through the Minister of Petroleum for State, Chief Timipre Sylva declared 2020 as the year of gas for Nigeria. After one year of attempting to pursue this goal, the Minister at the Joint International Energy Forum and International Gas Union (IEF-IGU) Ministerial Gas Forum in Malaysia, declared the period of 2021 to 2030 as the Decade of Gas.

According to him, the government was “pursuing programmes to grow [Nigeria’s] gas economies through the development of industrial and transport gas markets, in juxtaposition with gas-to-power initiatives.”

Speaking sometime in February this year at a public hearing of the House of Representatives on gas flaring, the Minister said, “We believe that with all the programmes we have in place, we are on course to achieving complete elimination of gas flaring by the year 2025,” veering away from the country’s initial goal of ending gas flaring by 2020, a curiously earlier target than the global target of the World Bank Global Gas Flaring Reduction Partnership (GGFRP) to which Nigeria belongs.

READ: How Nigeria can make more money from Oil?

Having failed at its 2020 target, the country has in its typical manner set another goal for 2025. This is unsurprising since the first target date to end gas flaring in Nigeria was in 1984 – 37 years ago – a target missed without remorse. After that, the country set targets for 2007, 2008, and 2010, none of which were met. There is very little confidence in its promise to meet any goals it purports to have now.

At the recently concluded Nigeria International Petroleum Summit (NIPS), the Minister highlighted a point that has been obvious in Nigeria since the days of NEPA. He said, “In the area of domestic utilisation of gas to power the economy, there is a chronic shortage.” Perhaps it is necessary to point out to the Minister that this chronic shortage is fuelled by government inefficiencies, like the failure to proceed with the Nigerian Gas Flare Commercialisation Programme (NGFCP) with investors on the queue. Nigeria, while in dire energy poverty was recorded by the International Energy Agency in 2020, as the 7th top gas flaring destination in the world.

One report reveals that between January and November 2020, alone, the country flared 198.12 billion SCF of gas, amounting to an estimated loss of $507.19m (or N192.22bn). This is not to mention the environmental effects of gas flaring, which PwC has estimated to amount to some N28. 8 billion (US$94 million) annually. Yet, the NGFCP launched in 2016 is yet to roar to life five years after it was conceived. When the programme launched in December 2016, it was greeted with fanfare, as many were excited about the possibility of ending gas flaring and utilising flare gas to improve the economy.

The programme crawled along until 2019 when it seemed to crackle to life before it died again. For a government that has claimed overly ambitious gas flare reduction target dates, declared a decade of gas, and included emission reduction targets under its Nationally Determined Contributions for the Paris Agreement, it is disgraceful that it has failed to play its part in bringing the gas flare programme to fruition.

One cannot blame investors here, as over 850 participants indicated an interest in the programme, and 238 of them submitted Statements of Qualification for the second stage, but the selected 205 participants have been made to wait without an end in sight to receive their Request for Proposals. This is bad for investor confidence.

According to the programme manager of the NGFCP, Justice Derefaka, “the NGFCP has the potential of generating approximately $3.5 billion of inward investment into Nigeria, [and] to impact the country’s Gross Domestic Product (GDP) by an estimated $ 1 billion per annum.” He further stated that the programme could “potentially unlock 2 to 3 LNG trains, around 3000MW electricity generation as well as generate circa 600,000MT of LPG per year, giving 6 million households access to clean energy through LPG.”

This means that not only is Nigeria losing money and killing its population flaring gas, it is also depriving itself of money and the economic and social development it could have gained if it had put in place the requisite regulatory and operational infrastructure. In fact, the NGFCP alone could be a major driver of Nigeria’s COVID-19 recovery. For a programme in which it would not be spending any federal funds to set up infrastructure, one wonders what has led to such long-winded delay.

Nigeria is adept at paying lip service to developmental commitments. At first, when the NGFCP process failed to proceed with its 2020 timelines, the pandemic was to blame. In the same period of the pandemic, however, the NLNG Train 7 deployed, the ANOH gas project deployed, the Brass Methanol Plant deployed, the Dangote fertiliser deployed and the Dangote refinery is underway.

The common thread among these is that they are private-sector-led. While these have gone on, the government has failed to play its part in putting in place the operational framework for the NGFCP and the Petroleum Industry Bill. A decade of gas with no substantial gas legislation/regulation and operational framework is both ironic and befuddling.