The bulls returned to the equity market during the week ended March 26, 2021 after 7 consecutive weeks of loss on the market. At the end of the week, NSE market capitalisation grew to N20.52 trillion from N20.08 trillion (2.17%) in the prior week.

During the week, the price of 48 equities appreciated, 18 equities declined, while the price of the remaining 96 equities remained unchanged in the market.

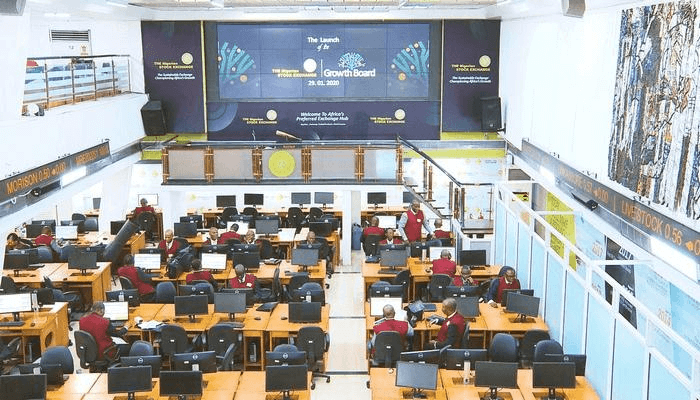

Equity market performance

The total turnover of shares reduced in the week ended March 26, 2020 from 2.34 billion shares in the prior week to 1.53 billion shares. The value of the traded shares however increased from N19.27 billion in the previous week to N21.31 billion.

The higher bidding for 48 appreciating stocks on the NSE pushed the NSE ASI to gain 2.17% in the week. Other indices also closed higher with the exception of NSE MERI Value and NSE Sovereign Bond which marginally declined by 1.54% and 0.13% respectively.

Also, NSE AseM, NSE AFR Div Yield, and NSE Growth Indices all closed flat at the end of the week. The other indices that appreciated are:

- Main Board Index: +2.97%

- NSE 30 Index: +2.64%

- NSE CG Index: +1.81%

- Premium Index: +1.35%

- Banking Index: +0.21%

- Pension Index: +2.49%

- Insurance Index: +0.94%

- NSE-AFR Bank Value Index: +3.09%

- MERI Growth Index: +5.19%

- Consumer Goods Index: +1.41%

- Oil/Gas Index: +0.69%

- Lotus II: +1.59%

- Industrial Goods Index: +2.94%

The Financial Services industry again topped the activity chart on the NSE in the week, trading 1.1 billion shares worth N12.29 billion in 11,106 deals. The total equity turnover and value of the financial services industry at the end of the week represented 71.67% and 57.69 of the entire market’s total equity turnover and value respectively.

The consumer goods industry was the next top activity sector. A total of 177.67 million shares worth N3.58 million were traded in 3,139 deals. The conglomerates followed, having traded 99.61 million shares worth N216.99 million in 856 deals.

Union Bank Nigeria Plc, Guaranty Trust Bank Plc, and Dangote Sugar Refinery Plc were the top traded equities by volume. They contributed 44.95% and 44.56% to the total equity turnover volume and value respectively at the end of the week.

UBA Plc marked down its stock price on Monday, from a closing price of N7.15k to N6.80k after the deduction of N0.35k dividend per share. Ardorva Plc also marked down its stock price on Friday, from a closing price of N15.4k to N15.21k after the deduction of its N0.19k dividend per share.

Some of the top gainers and losers in the market during the week are shown below:

Exchange-Traded Products (ETPs)

There was a significant drop in trading of ETPs during the week. A total of 25,905 units were traded, 94% lesser than the 435,459 units traded in the prior week. Also, the value of units traded declined by 91% week-on-week from N2.35 billion in the prior week to N208.95 million.

The 5 ETFs traded during the week are NEWGOLD, SIAMLETF40, VETBANK, VETGOODS, and VETGRIF30. The remaining 7 listed exchange-traded funds were not traded in the week.

Fixed Income Securities Market

On Wednesday, March 24, 2021 two Federal Government of Nigerian (FGN) Savings Bonds were listed on the NSE. 5.181% FGS MAR 2023 bond with total units of 357,419 was listed at N1,000 each.

Also, 6.181% FGS MAR 2024 bond with total units of 504,244 was listed at N1,000 units each. The coupon payment dates for both saving bonds will be 10 June, 10 September, 10 December and 10 March.

Although deals increased in the bonds market from 20 in the prior week to 47 deals at the end of the week, March 26, 2021, the total units and value traded declined by 69% and 68% respectively. A total of 93,124 units valued at N97.45 million were traded in the week.

Specifically, the bonds traded are: FGSUK2027S3, FGS202267, FGSUK2024S1, FGS202259, FGS202154, FGS202257, FG132036S2, FG132026S1 and FGS202265.