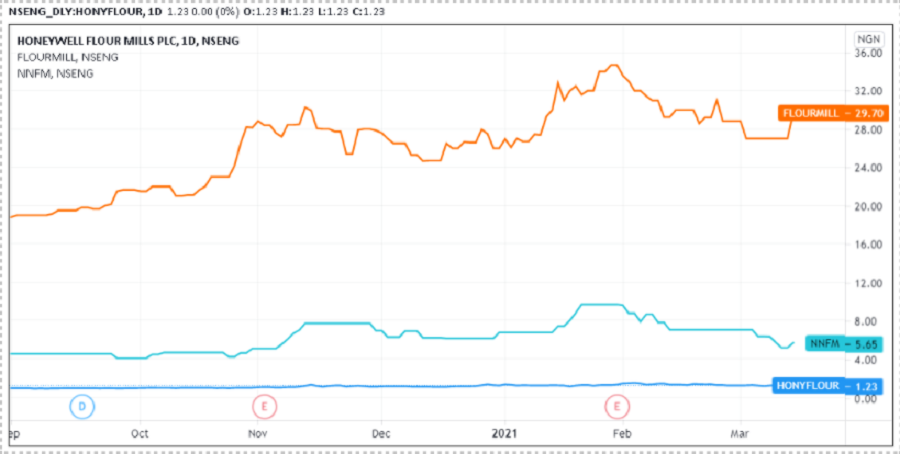

The Flour milling companies on NSE had a relatively bullish run this week, with the shares of two of these millers closing in green, despite the prevailing negative sentiment in the market which saw the NSE All-Share-Index depreciate by -1.74% W-o-W. (-4.03% ytd).

The joint market capitalization of the three flour millers –FlourMills, Honeywell and Northern Nig. Flour Mills – on NSE increased by a total N11.6 billion value this week.

The rise in the shares of Flour Mills of Nigeria Plc (:Flourmill) and Honeywell Flour Mills Plc (:Honyflour) saw the total market value of the millers’ gain an impressive N11.71 billion at the close of trade this week.

READ: Flour Mills and its diverse challenges

Despite the 10% gains in the shares of Flourmills and 6.96% increase in the share price of Honyflour, the gains of the millers this week was pressured down to the tune of N11.6 billion, as a result of the 10.6% dip in the shares of Northern Nigerian Flour Mills (:NNFM).

Data tracked on the NSE website revealed that the market capitalization of Flourmills and Honyflour increased by N11.1 billion and N634 million respectively. While NNFM lost a total N119 million to close the week 10.6% lower, relative to its market value last week.

READ: Nigeria’s border reopening will not impact profitability in 2021 – Flour Mills GMD

What you should know

- The NSE All-Share Index and Market Capitalization depreciated by 1.74% to close the week at 38,648.48 and N20.221 trillion respectively.

- While, the NSE Consumer Goods Index (CGI), an index that tracks the performance of key consumer goods companies as well as the performance of the flour millers, rose by 2.18% W-o-W, to close at 539.85 index points. (-5.84 ytd).

- Flour Mills made it to the list of best-performing stocks on NSE for the week, with a 10% price increase. While shares of Champion Breweries, Regency Assurance and Smart Products closed the week as the best-performing stocks on NSE.

- On the flip side, NNFM made the list of the top losers, on the stance of the 10.6% loss its shares printed this week.