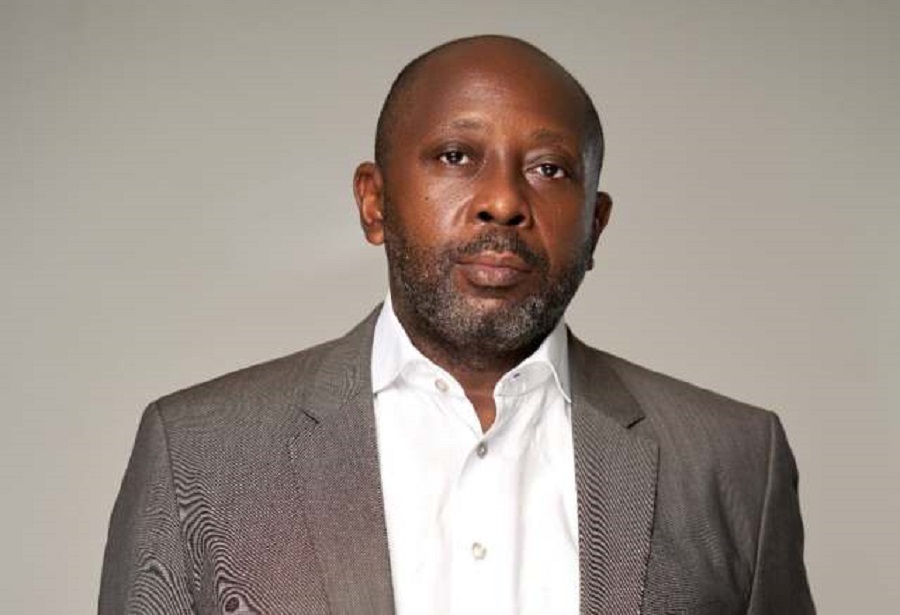

Mr. Omoboyede Olusanya, the Group Managing Director of Flour Mills Nigeria Plc has disclosed that the recent reopening of the nation’s land borders will not adversely impact the performance and profitability of the company in 2021 and beyond.

He added that FMN will continue to leverage brand loyalty, product standardization and innovation, as well as improved cost efficiency to increase profitability in 2021.

This statement was made by the Olusanya during the company’s 9M’20/21 Investor Webinar which held virtually on January 26, 2020.

According to the statement made by Mr. Olusanya at the virtual meeting, the reopening of the nation’s land border will not affect the company’s sales and revenue, as Flour Mills Nigeria is focused on increasing operational efficiency with accelerated plans for cost optimizations across the group to ensure competitive product offerings and profitability in the new operating environment, occasioned by the border reopening.

He revealed that the company will continue to invest in local content development, production capacity and aggregation to strengthen product innovation and product standardization in a bid to foster brand loyalty.

In line with this, Flour Mills Nigeria has invested heavily to upscale its Regional Distribution Centers (RDCs), in order to gain direct access to consumer market segments across the country, and expand consumer reach with the road to market initiatives and product offerings across the group, especially in the B2C segment.

Olusanya revealed that the group has successfully opened new regional distribution centers (RDCs) in Kano, Magboro and Abuja targeting the new fast-growing B2C product categories (fats, sugar and garri).

He added that the FMN Group among other strategic investments made, has invested in trucks to support the RDCs, animal feeds and starch value chains; as well as sales force automation platforms to ensure high-quality processes and services.

He concluded that the activities of the company will be complemented by the efforts of the nation’s border security, as these agents would ensure that the borders do not become porous, and would help to curtail markets from being proliferated by imported items.

What you should know

- Recall that Nairametrics reported that Flour Mills Nigeria Plc declared a profit of N5.65 billion in the third quarter ended, 31st December 2020.

- The report revealed that the profit which Flour Mills made in the third quarter of its accounting year 2020/2021 rose by a whopping 150.36% when compared to the profit it made in the corresponding period of 2019.

- It is important to note that the impressive performance of the company was driven by the agro-allied segment. The Agro-Allied segment benefited immensely from the August 2019 border closure, as the profit from this segment improved by 15,268%.