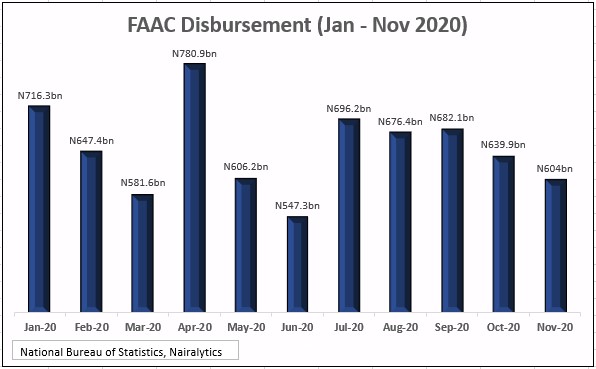

The Federation Account Allocation Committee (FAAC) disbursed the sum of N604 billion to the three tiers of government in November 2020 from the revenue generated in October 2020.

This is stated in the Federation Account Allocation Committee (FAAC) report for the month of November 2020, recently released by the National Bureau of Statistics (NBS).

According to the report, the monthly disbursement declined by 5.6% compared to N639.9 billion shared in October 2020 and 11.4% lower than N682.1 billion disbursed in September 2020.

READ: FAAC disburses N1.945 trillion in Q1 2020, highest Q1 allocation since 2014

Breakdown

- The amount disbursed comprised of N377.15 billion from the Statutory Account, N72 billion from Distribution of FGN Intervention Fund, Distribution of N20 billion from Stabilization Account, N7.39 billion from FOREX Equalisation Account, and N1 billion from Excess Bank Charges Recovered.

- The Federal Government received a sum of N231.29 billion from the total allocation of N604 billion. States received a total of N167.17 billion and Local governments received N124.71 billion, while the sum of N31.90 billion was shared among the oil-producing states as 13% derivation fund.

- Also, revenue-generating agencies such as Nigeria Customs Service (NCS), Federal Inland Revenue Service (FIRS), and Department of Petroleum Resources (DPR) received N5.19 billion, N10.17 billion, and N3.87 billion respectively as cost of revenue collections.

- Further breakdown of revenue allocation distribution to the Federal Government of Nigeria (FGN) showed that the sum of N158.21 billion was disbursed to the FGN consolidated revenue account; N4.05 billion shared as share of derivation and ecology.

- A sum of N2.03 billion was disbursed as stabilization fund; N6.81 billion for the development of natural resources; and N5.18 billion to the Federal Capital Territory (FCT) Abuja.

READ: House of Reps summon Emefiele, NNPC GMD over unremitted N3.24 trillion

States with highest net allocation

- Delta State received the giant share in the month of November 2020, with a total allocation of N14.02 billion, representing 8.13% of the total disbursement.

- Akwa Ibom followed with N10.82 billion (6.27%) closely followed by Rivers State with a total allocation of N10.01 billion (5.8%), Lagos State received N9.65 billion (5.6%) while Bayelsa received N6.76 billion (3.92%).

- On the other hand, Cross River State received the lowest allocation of N2.49 billion, followed by Osun State with N2.55 billion, Plateau (N2.76 billion), Ogun State (N2.96 billion), and Ekiti State (N3.14 billion).

Debt deductions

- A total of N6.45 billion was deducted from the allocations of the 36 states as part of external debt deductions.

- Lagos State parted with N2.44 billion, the highest deduction compared to other states, Kaduna followed with N537.7 million, Oyo State (N378.7 million).

- Others on the list of top five states include; Cross River (N311.3 million), and Rivers State with N227,1 million debt deduction.

READ: Nigerian banks issued N774.28 billion new loans in December 2020

Upshot

- The federal allocation to the three tiers of government continues to decline on the back of reductions in government revenue, as a result of the crash in oil prices triggered by the Covid-19 pandemic and global oil price war.

- Meanwhile, crude oil prices have rallied above $60 per barrel, signaling relief for the Nigerian government as oil revenue still constitute the larger chunk of its income.

- However, it is imperative for state governments to strategize means of generating sufficient revenue internally so as to meet up with their various state obligations.