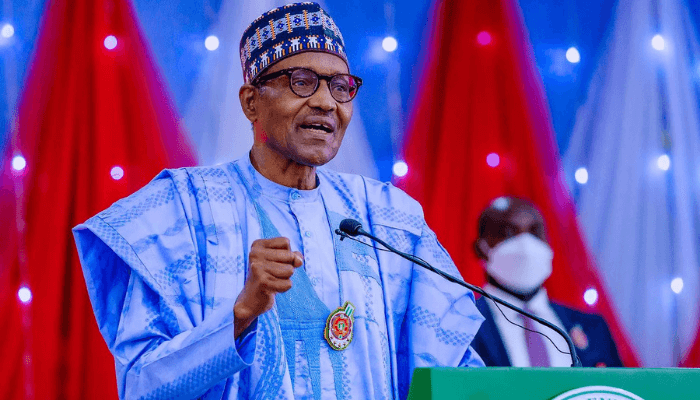

President Muhammadu Buhari said he will enforce tough measures against any electricity distribution company (Discos) or their agents selling prepaid meters to their consumers, against the directive that they should be distributed free.

According to a report from Punch, this disclosure was made by the Special Adviser to the President on Infrastructure, Ahmed Rufai Zakar, who represented President Buhari at the FGN/NLC-TUC ad-hoc committee on electricity tariff stakeholders engagement in Ibadan, Oyo State on Wednesday, December 2, 2020.

He said the President understands the plight of Nigerians on issues surrounding electricity and is determined to deal with bad elements.

(READ MORE: Power: Distribution of meters resumes in Lagos, Abuja, Kaduna and others)

What they are saying

He said, “We have made it very clear through the regulator’s direct order, as well as intervention from the Ministry of Power that the meters are to be provided to Nigerians at no cost. Even for meters that were paid for, there is the directive from the regulator to the discos that they would need to find a way to reimburse those citizens over time.

“In cases where we find any disco or disco representatives selling the meters or exploiting Nigerians to be able to get meters by paying, we would take the full measures of the law. The President has mandated that these meters must be free. We have also said that they must come from local manufacturers. This would create jobs and revive our industry.”

What you should know

- The President had earlier directed that 6 million prepaid meters manufactured or assembled locally should be made available to electricity consumers to stop their opposition against estimated billing and even increase in electricity tariff.

- While stating that he remains committed to the protection of poor and vulnerable Nigerians from increased electricity tariffs and arbitrary estimated billings, the President said he is working to ensure that Discos commit to increasing the number of hours of electricity supply everyday and improve on the quality of service.

This cannot be right.

The distribution companies sell the metres to their customers openly without fear, the validity of this article is suspect.

Eko Electricity is an example.

It is true that distribution companies sell metres to their customer openly without fear,eg PHED. I have proves.

These are terrible times for citizens of this country. Meters are sold despite the president’s contrary directives or customers being deliberately over billed after the directives far above the sales prices of the meters. I received (Auchi under bedc) over 93k bill for the month of November 2020. Who’s fooling who?

All that Govt does is suitable words and painful actions. I paid for the prepaid meter,after the connection,they remove 50% of every recharge from my outstanding debts, which I was exorbitantly billed in the first place. So you journalists, when a statement is made, you need to take on the authority if there is compliance or otherwise…. FEEDBACK.