The National Insurance Commission (NAICOM) has issued operational licenses to six new insurance firms and one reinsurer.

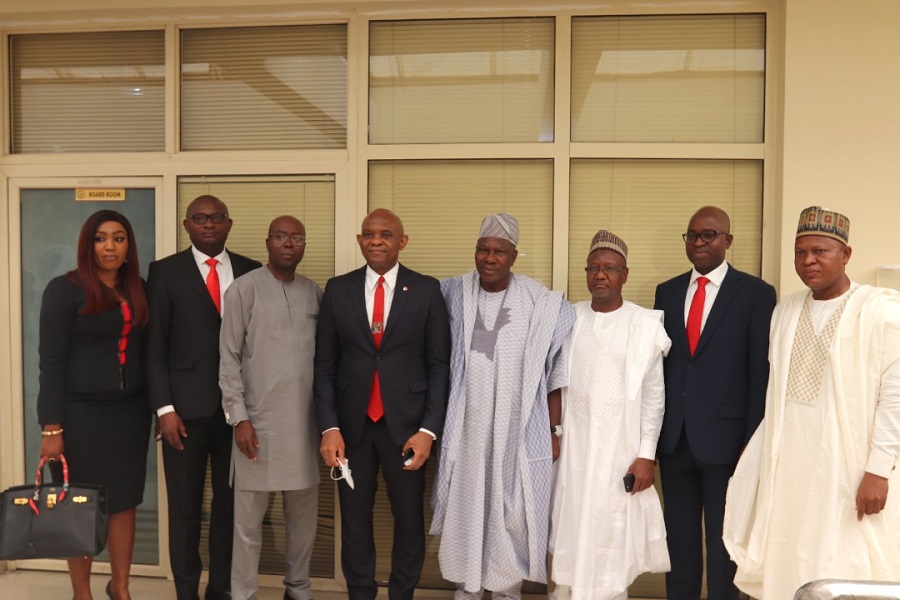

This was disclosed by the NAICOM boss, Mr. Sunday Thomas, while handing over operational licenses to the five firms at the NAICOM Head Office in Abuja today.

The new firms are Heirs Insurance Limited (General); Stanbic IBTC Insurance Limited; Heirs Life Assurance Limited; Enterprise Life Assurance Company Nigeria Limited; and FBS Reinsurance Limited, Salam Takaful, and Cornerstone Insurance Co. Limited.

According to Mr. Thomas, “The National Insurance Commission (NAICOM) received applications from the under listed companies for registration as Insurance and Reinsurance Companies to transact insurance and reinsurance business in Nigeria. In fulfilment of the statutory provisions of extant laws for the registration/licensing of insurance Companies, the general public is hereby informed that the Commission has commenced the process of registering the companies.”

READ: AIICO Insurance to increase share capital by 80%

What you should know

- Heirs Insurance Limited (General) has Mr. Olaniyi Stephen Onifade as its Managing Director; Mr. Akinjide Orimolade, Stanbic IBTC Insurance Limited; Mr. Abah Okoriko, Heirs Life Assurance Limited; and Mrs. Fumilayo Abimbola Omo, Enterprise Life Assurance Company Nigeria Limited.

READ: Why African Alliance has not released its FY 2019 and Q1 2020 results

- FBS Reinsurance Limited is to be led by the former Commissioner of Insurance, Fola Daniel, along with other seasoned professionals from the brokerage and underwriting units of the industry like Bala Zakariyau, the former Managing Director of Niger Insurance, Ahmed Olaniyi Salawu of the Standard Insurance Consultants, and Wole Oshin of the Custodian Investment Plc.

READ: Retiree Life Annuity fund portfolio increased to N463 billion in 2020 Q2

- Takaful Insurance is based on sharia or Islamic religious law, which explains how individuals are responsible for the protection of one another. Takaful Insurance policies cover health, life, and general insurance needs. It is introduced as an alternative to those in the commercial insurance industry, which is believed to go against Islamic restrictions on interest, gambling, and uncertainty principles – all of which are outlawed in sharia.