President Muhammadu Buhari has called for the alignment of capacity and attraction of investments across the generation, transmission and distribution components of the Power Sector’s value chain.

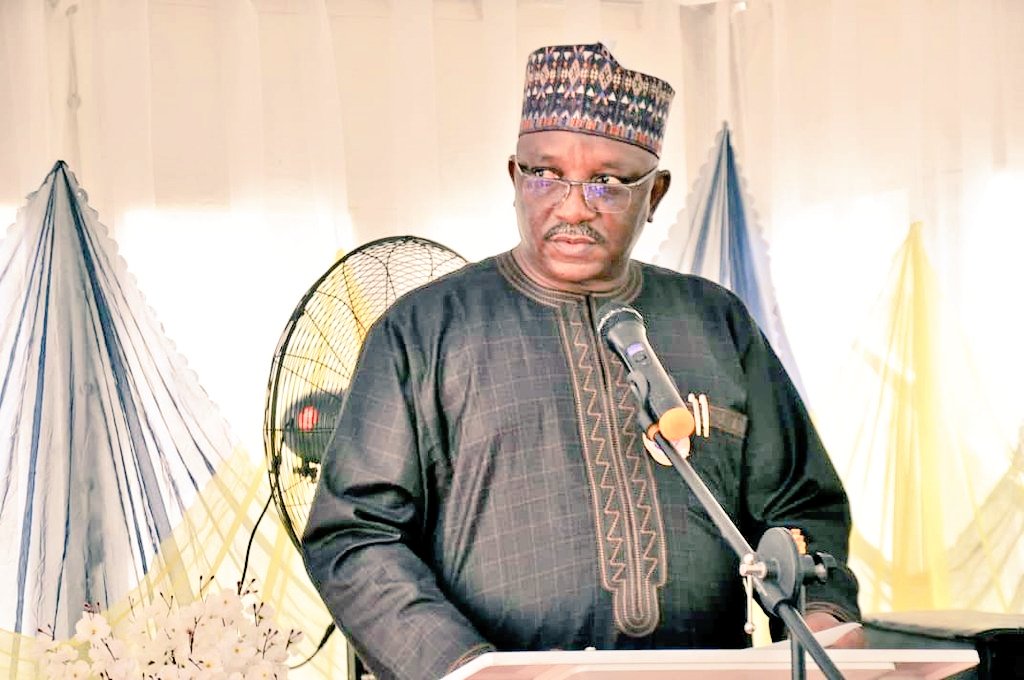

This was disclosed by the Minister of Power, Engr Salam Mamman, who represented the President, in a speech read at the launch of Eko Electricity DisCo’s Supervisory Control and Data Acquisition (SCADA) system in Lagos on Thursday.

He said, “We must ensure that there is an alignment of capacity and attraction of investments across the generation, transmission and distribution components of the Power Sector’s value chain.

“I acknowledge the Central Bank of Nigeria’s (CBN) financial support towards this project through the Nigeria Electricity Market Stabilization Facility granted in 2015. This facility significantly led to the successful completion of this project.

“My administration remains committed to addressing the liquidity challenges which are adversely affecting the Power sector’s viability. We have noted with grave concern: The increased fiscal burden on the Federal Government (FG) occasioned by the tariff shortfalls in the sector which are no longer sustainable.”

Bottom line

It is obvious that the CBN’s Payment Assurance Facility (CBN PAF) targeted at supporting tariff shortfalls can no longer be extended and must be phased out to allow the sector’s financial independence.

The government is also aware that these tariff shortfalls sit on DisCos’ books and impair their ability to raise capital and invest.

https://twitter.com/PowerMinNigeria/status/1332047158338596866?s=19