The Federal Government has proposed to slash import duties of tractors, transport vehicles, and others to further cushion current socio-economic conditions in the country.

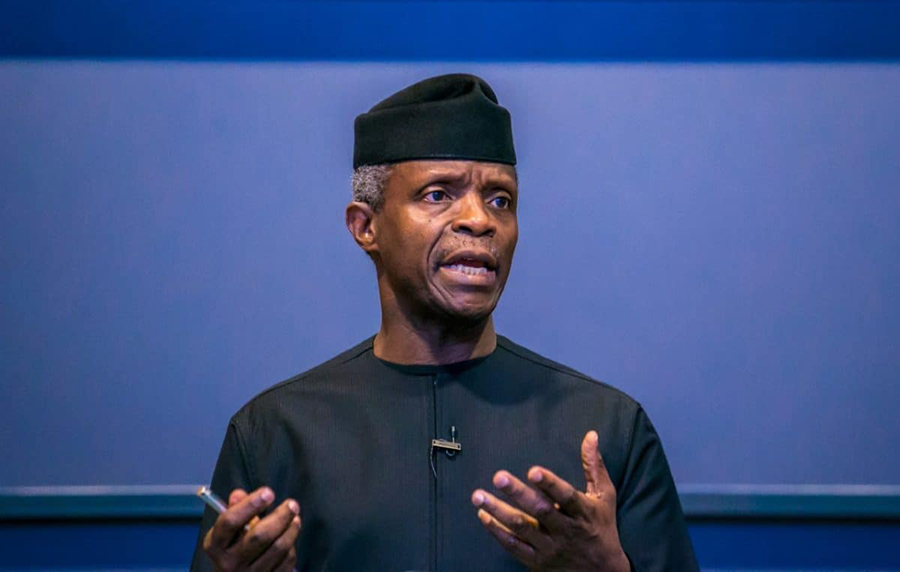

This was disclosed by the media aide of Vice President Yemi Osinbajo, Laolu Akande, on Wednesday via his Twitter handle.

READ: How FG makes N1 trillion from reforms, anti-graft operations

He tweeted:

“President Muhammadu Buhari’s administration is proposing more tax incentives in the 2020 Finance Bill including import duty reductions from 35 to 10% & 0% levies on tractors, transport vehicles & co, 50% reduction of minimum tax, specific TETFUND exemption.

“There would also be tax relief for contributions to the COVID-19 Relief Fund, while retirees’ compensation exemption threshold is to be raised from N10,000 to N10million & software acquisition would now qualify as capital expenditure allowing for tax recovery of same. Expect more.”

READ: FG rejects calls for tax reduction, offers tax relief for donors to intervention funds

To further cushion current socio-economic conditions, Buhari adm is proposing more tax incentives in the 2020 Finance Bill including import duty reductions from 35 to 10% & 0% levies on tractors, transport vehicles & co, 50% reduction of minimum tax, specific TETFUND exemption…

— Laolu Akande (@akandeoj) November 18, 2020

Earlier on Wednesday, Nairametrics had reported that the Federal Government had approved the 2020 Finance Bill to support the 2021 Budget, saying that it had no plans to increase the tax burden on Nigerians.

The decision was taken at a meeting of the Federal Executive Council (FEC), which was presided over by President Muhammadu Buhari.

READ: Crypto: Alpha Finance gains 400% in 10 days, supported by a big bank

According to tweet posts from the Federal Ministry of Finance, Budget and National Planning on its official Twitter handle, the disclosure was made by the Minister of Finance, Budget and National Planning, Zainab Ahmed, on Wednesday, November 18, 2020, while briefing State House correspondents on the outcome of the FEC meeting.

Explore Data on the Nairametrics Research Website

Please does the exemption include Toyota Sienna for transportation

When do we expect the slash in import duties to take effect?