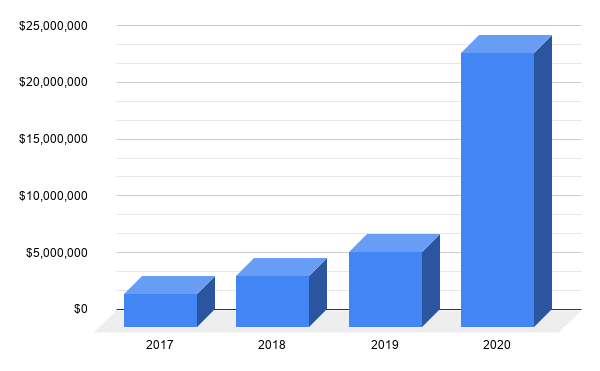

Crypto Scammers gained about $24 million worth of BTC in the first six months of 2020, according to reports from watchdog Whale Alert.

As the COVID-19 pandemic kept a lot of individuals more active online, scammers have pulled dozens of different types of scams such as fake ICO’s, BTC recovery, fake exchanges, giveaways, video scams, fake tumblers, Ponzi schemes, malware and many more.

Some of the most successful scams include a crypto fraudster making more than $130,000 in 24 hours with just a single web page, a BTC address, and decent amount publicity on YouTube.

Explore useful research data from Nairametrics on Nairalytics

Another crypto scammer made away with over $1.5 million within the period of 6 months promoting a fake crypto exchange with a poorly designed website riddled with typo errors.

The scammer deceives their intended victims by offering one or all of the following that includes no taxes, high profits, little effort, and no risk, it’s thus projected by Whale alert that these fraudsters could gain about $50 million dollars before the end of 2020

Recall that a few months ago Nairametrics had earlier reported how thousands of Bitcoin investors have, over time, been defrauded of their hard-earned money around the world. The crypto fraudsters use both old and new tactics to defraud their targets in schemes based on BTC exchanged through online ledgers known as the blockchain.

READ ALSO: How to protect your bank accounts from hackers and fraudsters

However, you should remember that the use of cold wallets or a proprietary smartphone is recommended. These are specifically designed tools to keep your bitcoin from falling into the hands of hackers on the internet.

READ ALSO: BTC whale moves 19,630 BTC valued at $185,000,000

Next time you are thinking of investing your funds in a BTC fund or firm, consider the promised returns versus the performance of the cryptocurrency market.