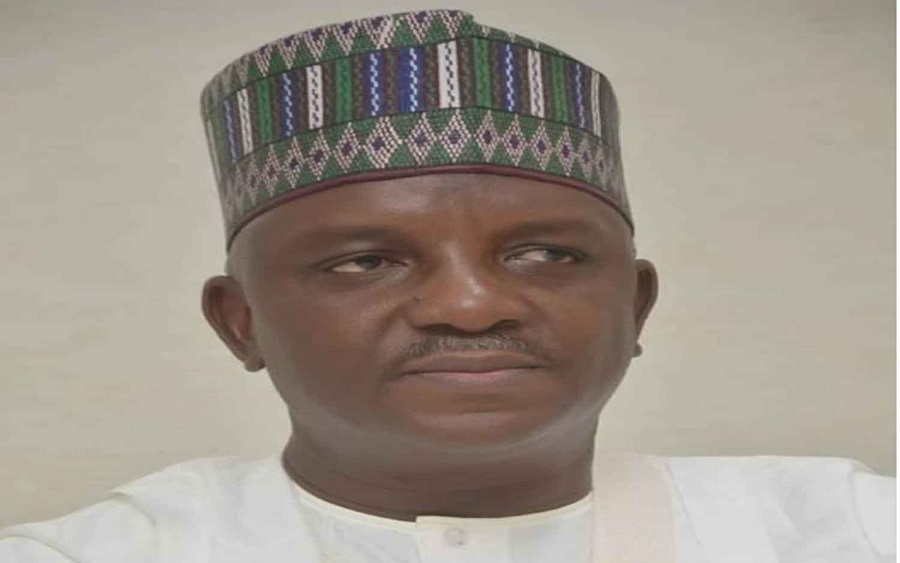

The Minister of Power, Sale Mamman, has asked all contractors handling power projects across the country to return back to project sites following the gradual relaxation of the lockdown by the Federal Government, due to the coronavirus pandemic.

The directive from the minister was contained in a press statement by the Special Adviser to the Minister on Media and Communications, Aaron Artimas, on Sunday, July 12, 2020, in Abuja.

The power minister gave the directive during an inspection visit to the new Gagarawa 2 by 60 Mega Volt Amp (MVA) 132/33 Kilo Volt Sub-station being constructed by the Transmission Company of Nigeria (TCN) in Jigawa.

Mamman, lamented the negative impact of the coronavirus pandemic on the power sector, pointing out that the sector was among the worst affected with the entire value chain directly or indirectly counting losses.

READ MORE: How Geregu Power became one of the best performing power plants in Nigeria – Akin Akinfemiwa

The Minister in the statement said, ‘’I can tell you that the impact of the pandemic is huge in the power sector as a real service provider. We, however, have joined the government effort to restart the economy with the easing of the lockdown and opening of the interstate road.’’

“I direct all contractors handling power projects to return to sites and work assiduously to recover from the losses recorded during this lockdown,” he said.

Mamman said the Gagarawa Sub-station project would boost power supply in over 7 local government areas including an industrial area.

On his part, the Jigawa State Governor, Abubakar Badaru, who was part of the inspection team, commended the power minister’s effort at ensuring completion of these projects that have been on for over 20 years.

Download the Nairametrics News App

The News agency of Nigeria (NAN), reports that the sub-station is 99% completed and has been energized.

The acting Managing Director of TCN, Suleiman Abdulaziz, who was also part of the inspection asked for speedy completion of similar sub-station across the country.