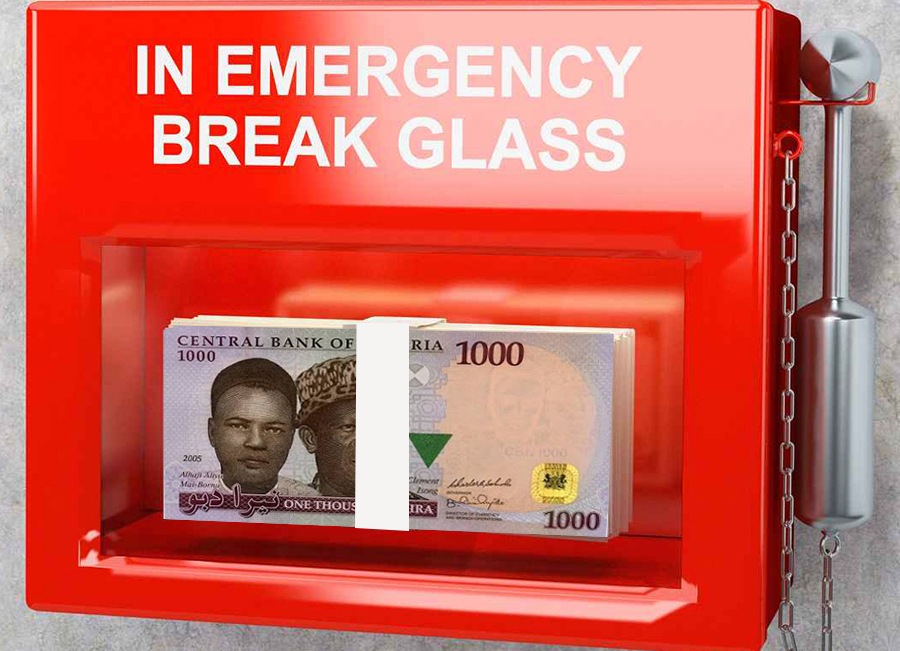

Can you raise N50,000 cash tomorrow? Yes cash, without selling any asset of yours; Can you? This is a very important question you need to ask yourself. One generally accepted lesson from the 2020 economic downturn for both corporations and individuals is to always have an emergency fund (EF). So, what is an Emergency Fund? How is it set up? How is it used? Let us explore.

What is Emergency Fund

An EF is a savings account set up to pool and hold a minimum of three months of calculated Non-Discretionary Income (NDI). The EF is advised as the first activity any investors should undertake. Specifically, before even investing a cent, set up and maintain an EF because this fund acts as an “insurance” or stop-gap for your income or investment portfolio.

How is an Emergency Fund set up?

An EF captures a minimum of three months of Non-Discretionary Income (NDI). What is NDI? These are expenses incurred that must be settled irrespective of income. For instance, rent must be paid, groceries must be paid, we cannot simply stop paying utility bills because we lost our job and thus income.

Once we decide on an investment plan, the first thing to do is to list out all expenses we will incur and attach a cost to them per month or annual basis but corresponding to the period of payment. We do this to identify the necessary expenses which we refer to as the NDE.

List of expenses

- Rent N1,500

- School fees N500

- Camping/Holiday N300

- Go to Movies N100

- Groceries N400

- Cable TV N200

- Gas for cars N200

- Phone Bill N300

- Eating out Dinner N200

Total expenses for the month are 3,500

Next, decide which of the expenses listed above are Non-Discretionary. In other words, which of these expenses must be settled irrespective of income? Let us assume our client chooses the following as NDE:

- Rent N1,500

- School fees N500

- Groceries N400

- Gas for car N200

- Phone bills N300

These expenses above come to a monthly NDE of 2,900, with a three months minimum of 8,700. This minimum sum means that should the client lose his job or suffer any other income interruption, these necessary expenses will be paid from the emergency fund, without the need to sell down investment assets at fire-sale prices just to raise income.

How is it used?

The Emergency Fund is simply a piggy bank. Once it is set up, you can increase the minimum saving from 3 to 4 and as high as you want to go. What is does is insulate your investment portfolio from losing any compounding or dissipation in principal because you must sell. So, if there is income interruption due to job loss or you simply want to take a long holiday and write a book, you can do so and still meet your expenses from these savings.

An EF is not only for downturns, as it is also good for opportunities. A friend of mine bought an almost brand new car from a work colleague that was emigrating abroad because he could pay cash immediately in short notice. Cash is always king when you are in a tight negotiation with a seller.

Your Emergency Fund should be kept in cash or near cash investments. Return on investment for the EF is secondary to access to those savings. Also, you want your EF in an investment class with fixed income with no variation in returns. this means in practical terms do not invest your EF portfolio in equities that pay a variable return or even any asset which may need documentation and visits before you can access your funds. I am also wary of a commodity like gold, which does hold value, but cannot easily be converted to cash. The recommended asset classes to invest your EF are:

- Call or Fixed Deposit in Banks

- Sovereign Treasury bills, they are easily discounted and converted to cash

- Certificates of Deposit with bank

If the asset call cannot be converted to cash in one activity should be avoided. Also, ask the institution if they charge fees for early withdrawal and what those fees are.

What can I do tomorrow?

- Start an emergency fund immediately. Do the expense exercise, determine your Non-Distortionary Expenses, start to build up a savings pot.

- Focus on building up your emergency funds before building a portfolio of assets.

I came back to read this again because I needed to be sure I’m doing it right. Thank you for this.

Accessibility to EF is more important than the returns on it ,,,, thank you for this