Last week, the Federal Ministry of Finance, Budget & National Planning (FMFBNP) released the revised 2020-2022 MTEF & FSP framework. This provided an opportunity to evaluate the fiscal performance of the Federal government in 2019 and Q1 2020. In 2019, the Federal government-generated Revenue of N4.60tn which pales in comparison with the budgeted N9.33tn indicating a 49.4% performance. However, it represented an increase of 6.1% y/y when compared with 2018.

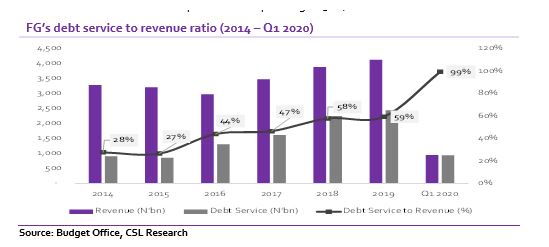

Despite the drop in revenue, the FG went ahead to implement 93.0% of its budgeted spending implying total expenditure of N8.29tn and a budget deficit of N4.17tn (Budgeted Deficit – N1.92tn). While expenditure was mainly recurrent expenditure with capital expenditure lagging budget by 44.4%, the FG spent N2.4tn on debt service cost which pushed debt service cost to revenue ratio higher to 59.4% for 2019.

READ ALSO: Nigeria’s fiscal quandry: A revenue problem or a debt problem?

Q1 2020 performance revealed the FG faced severe Revenue pressures due to the unprecedented decline in oil prices triggered by the coronavirus pandemic which dampened global demand for oil. In Q1 2020, retained revenue was N950.56bn which represents a 48.3% performance to prorated budget of N1.97tn.

We express our concern on the elevated debt service cost of N943.12bn which implies a debt service cost to revenue ratio of 99.2%. We note the 2020 budget provided a prorated amount of N681.37bn for debt service costs which implies an overshooting of 38.4% on debt service costs.

We are increasingly worried about the government’s ballooning deficits and unsustainable debt service costs. While we note that the upward adjustment in the official exchange rate for conversion of dollar revenue as well as debt relief from bilateral & multilateral lenders may provide some succour, we believe the severity of disruption to oil and non-oil Revenue would put the FG in a precarious state in Q2 and Q3. Thus, we believe the FG must implement fiscal consolidation measures to manage its expenditure. In addition, implementing policies aimed at improving the business environment will help mitigate the impact of the global pandemic on the profitability of private sector enterprises, thus providing support for non-oil revenue.

@Copyright CSL STOCKBROKERS LIMITED, 2020. All rights reserved.