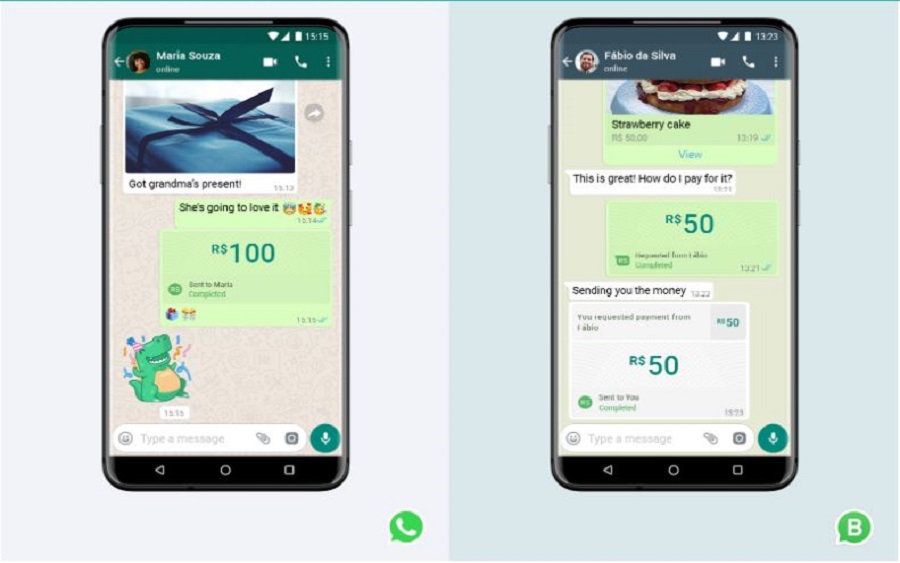

WhatsApp, which is owned by Mark Zuckerberg’s Facebook Inc., announced earlier today that it has finally launched its digital payment service. The project, which had been under development for a while, was launched in Brazil in what can best be described as a trial phase.

WhatsApp users in Brazil, which is one of South America’s biggest economies, now have the opportunity to pay for their transactions and send money across to loved ones, albeit securely.

A statement that was made available by WhatsApp, as seen by Nairametrics, explained that simplifying payments makes it easier to “bring more businesses into the digital economy, opening up new opportunities for growth.”

Note that the new WhatsApp payment feature is enabled by Facebook Pay which was launched last year. The company said that the immediate objective is to make it possible for WhatsApp users to send money just as easily as they send messages.

Eventually, Facebook hopes that users of its Facebook Pay (i.e., both regular users and businesses) can be able to seamlessly use their card information across the rest of Facebook’s sister companies, including Instagram.

“In addition, we’re making sending money to loved ones as easy as sending a message, which could not be more important as people are physically distant from one another. Because payments on WhatsApp are enabled by Facebook Pay, in the future we want to make it possible for people and businesses to use the same card information across Facebook’s family of apps,” part of the statement said.

For now, the WhatsApp payment solution works in such a way that users would be required to have a unique six-digit pin, or better still use their fingerprint. This is a security measure that is intended to prevent unauthorised access by third parties.

Users would also be required to link their WhatsApp to debit or credit cards. This will be done on either the Visa or Mastercard networks. Now, because this is a limited launch only in Brazil (for now), only debit or credit cards from the following Brazilian banks will work —Banco do Brasil, Nubank, and Sicredi. Facebook said it is also partnering with Cielo, a leading Brazilian payments processor.

“To start, we will support debit or credit cards from Banco do Brasil, Nubank, and Sicredi on the Visa and Mastercard networks -and we are working with Cielo, the leading payments processor in Brazil. We have built an open model to welcome more partners in the future.”

For now, the service is free for regular Brazilian WhatsApp users. However, businesses will be required to pay a processing fee before they can receive customer payments. This is similar to the fee such businesses would be required to pay when they accept credit card transactions.

Facebook, which is arguably the world’s most dominant social media company, has recently been diversifying into financial technology. It should be recalled that in January 2019, the company announced that it would be launching its cryptocurrency (Libra) sometime this year.

It is unclear when the WhatsApp payment solution will eventually become available in Nigeria. But if and when it does come to Nigeria, the service would be competing with already existing fintech companies in the country such as Paystack, Paga, and others.

Meanwhile, there is the question of whether regulatory authorities such as the CBN will even grant Facebook license to operate the service in Nigeria. Recall that the same question came up last year when Facebook announced that Libra was coming.

Reacting to this, financial expert and Nairametrics’ economic commentator, Kalu Aja, had said:

“If I were the CBN Governor, I will be worried. Potentially $ remittances could be sent via Libra, bypassing domiciliary accounts and Money Transfer like Western Union. Loss of revenues to Government is a clear threat here.

“Would not be out of place for banks to scenario-plan what will happen if cash is sucked out of Domiciliary accounts to Libra. An importer can simply open a cryptocurrency wallet buy libra and pay for import, no more bank fees.”