The global pandemic being faced by the world as we know is set to have major operational implications on businesses across the world and possibly dovetail into a recession.

With predictions of an incoming recession, many businesses and individuals alike have put things in place to prepare for the trying times ahead.

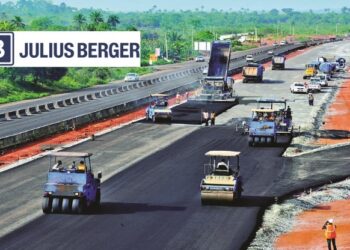

With the construction industry predicted to experience a major hit, given the halted state of activities, Julius Berger has taken cost-cutting measures to ensure its sustainability.

READ MORE: MTN Nigeria announces final dividend of N4.97 for FY 2019

Following a very good 2019 financial year, Julius Berger had announced a dividend pay-out of ₦2.75K per 50K share for the financial year ended December 31, 2019 and a bonus of 1 (one) new share for every existing 5 (five) shares held.

However, in an attempt to brace itself for the impending challenges, the board of the company withdrew its previously announced final cash dividend payment of ₦2.75K per 50K share, and instead recommended a final cash dividend pay-out of ₦2.00K per 50k share.

In a corporate action announcement, it revealed that the Board had “carefully considered the emerging social, operational, financial and economic impact of the COVID 19 pandemic, the outlook for Nigeria for the financial year 2020, and the impact on the business and cash flows of the Group.”

It is the company’s way of protecting its liquidity and ensuring long-term sustainability, while balancing the need for returns to shareholders.

READ ALSO: Dangote Industries targets $30 billion turnover by 2022

The savings it obtains from the reduced cash dividend of ₦2.00K, as well as its diverse measures to reduce operational and capex costs is to be retained within the business to protect its growth.

Businesses are, at this time, taking necessary actions to ensure business continuity and this is what the company has done. The Group’s financial position is still strong, however, as its Q1 results revealed.

Consequently, the board remains confident about its future, post-Covid-19.