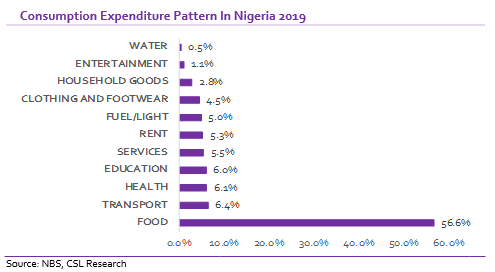

According to recent data published by the National Bureau of Statistics (NBS) on Consumption Expenditure Pattern In Nigeria 2019, 56.65% of total household expenditure in 2019 (estimated at N40.2 trillion) was spent on food with the balance of 43.35% spent on non- food items.

The breakdown of the data further revealed that three items were responsible for the largest proportion of household expenditure; food consumed outside the home (N4.59 trillion), transportation costs (N2.59 trillion) and starchy roots, tubers and plantains (N2.53) trillion- jointly accounting for 25.15% of total household expenditure in 2019.

READ MORE: Don’t have kids until you’ve hit these money milestones

Despite households spending over 50% of entire expenditure on food, we note that the country ranks poorly in terms of nutrition standards. According to UNICEF, Nigeria has the second-highest burden of malnourished children in the world, with a national prevalence rate of 32% of children under five. In our view, the high concentration of household spending on food is reflective of low levels of disposable income among the populace and the steep increase in the prices of food items.

On one hand, we attribute the low level of disposable income to high unemployment rates and declining job opportunities in the formal sector. Conversely, we believe the elevated prices of food items can be linked to the pass-through impact of weakening in the local currency via imported food items, infrastructural bottlenecks leading to increased costs of producing goods, and the incidence of communal clashes/ insurgencies in food-producing states which have resulted in a shortage of food items and in turn, higher prices.

READ ALSO: Budget: Bill to compulsory 40% allocation to capex passes second reading

Theoretically, the faster a nation transits from developing to a developed nation, the lesser the proportion of household income that is spent on food. This frees up more spending on nonfood items and ensures a higher level of savings, which is a precursor for increased investment.

READ ALSO: Atiku kicks as Buhari spends $3.7 billion in foreign debt service since 2015