According to recently released data from the Nigerian Stock Exchange (NSE) on domestic and foreign investor participation for March 2020, total value of transactions executed at the local bourse increased by 64% m/m to N242.9bn in March from N148.5bn in February.

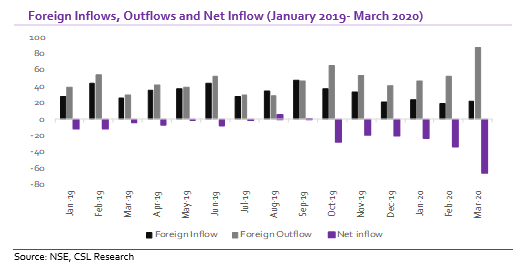

The breakdown of the data revealed that the growth in the value of transactions was largely driven by domestic investors (up 72% m/m) compared to their foreign counterparts (up 54% m/m). Interestingly, inflows (N98.3bn) outpaced outflows (N34.4bn), resulting in a net inflow of N63.9bn which is an increase of 1.9x m/m.

Foreign inflows grew 19% m/m to N22.5bn, while foreign outflows grew at a faster pace, up 68% m/m to N87.7bn. Consequently, net outflows spiked from N33.4bn in February to N65.2bn in March, the highest since May 2018.

We believe the intensified sell-off by foreign investors was due to the elevated global risk aversion for EM/FM assets, trigggered by the outbreak of the global pandemic.

The selldown by foreign investors is consistent with the broadly bearish trend in the month of March, as the NSE All Share Index shed 19%.

The sell off by foreign investors pushed the share prices of major bellwethers to historic lows, providing an attractive entry point.

Hence, we think the surge in net inflows from domestic investors in the month was purely driven by cheap valuations amidst elevated system liquidity driven by maturities from OMO bills and low yields on fixed income securities.

In the short to medium term, we expect this trend from domestic investors to persist, given the dislocation in the fixed income markets due to the heterodox policies adopted by the CBN.

(READ MORE: NSE Amplifies Social Distancing with Tuface Idibia)

On the other hand, although we began to see increased level of foreign investor participation in April, we believe this was driven by the inability of many foreign investors to get dollars for repatriation, forcing some to reinvest their funds.

We generally expect foreign investors’ interest to remain weak, owing to increased macroeconomic fragilities concerns on stability of the currency, amidst heightened uncertainties on the regulatory landscape in the banking sector.