The Lagos State Employment Trust Fund (LSETF) has suspended the repayment of loan obtained by 11,000 Micro, Small and Medium Enterprises (MSMEs) and technology start-ups in the state.

This was disclosed by the Acting Executive Secretary of LSETF, Teju Abisoye. According to her, the decision was taken to help reduce the financial burden, which was caused by the Coronavirus outbreak, on the MSMEs.

The COVID-19 pandemic has affected trade and other business activities globally, resulting in SMEs and even larger corporations seeking a halt on repayment of loan. In order to keep the struggling SMEs in business, LSETF has placed a moratorium on credit yet to be repaid.

Some SMEs had obtained loan from LSETF prior to the Coronavirus outbreak for their business growth, however, trade has been stagnant, so the moratorium is part of the relief measure by the state government to assist SMEs amidst the shutdown.

[READ MORE: CBN temporarily suspends settlement of failed Visa and Verve card transactions)

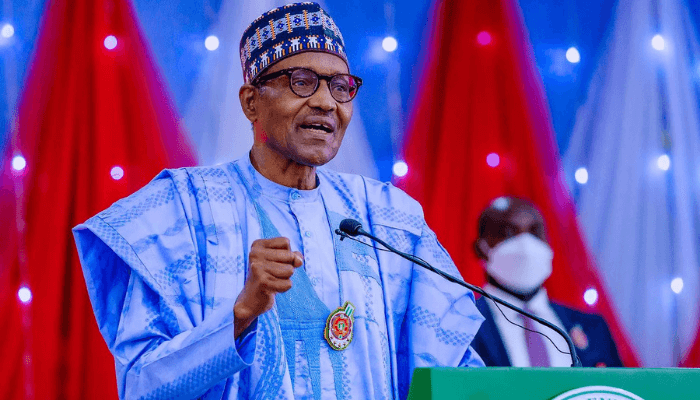

Nairametrics had reported that Lagos State government restricted movements before President Muhammadu Buhari ordered a lockdown in Lagos, Ogun and Abuja. The lockdown is expected to last for 14 days, but with Nigeria still struggling to trace over 6000 contact persons, SMEs and other startups might remain lockdown in Q2.

Abisoye said, “We are passionate and committed to enabling every productive resident in Lagos to dream, grow and succeed in their endeavours. We are keen to help them get access to affordable financial and other institutional support they need to create wealth and employment for our youth, while significantly contributing to building a 21st Century Economy for Lagos in alignment with the State Government’s THEMES agenda.

“We understand that to do this; we must engender an enabling environment for small businesses to operate and thrive. In recognition of the difficulty that businesses may encounter this period, we understand that many of them will not be able to meet their loan repayment obligations.

“Therefore, we hope this announcement will serve as a spark of optimism in anticipation of a quick return to normalcy and business continuity. We also urge them to adhere strictly to the recommendations of the World Health Organisation (WHO) and the relevant health authorities in Nigeria as we all work together to end this pandemic.”

READ ALSO: Age of Start-ups: Familiar path of companies that failed test of time in Nigerian market

Meanwhile, LSETF also suspended the “Lagos Innovates Workspace Vouchers Program”. The program was designed to support and facilitate access to well-equipped workspaces and learnings for potential innovators and founders of start-ups in the Lagos tech ecosystem was suspended for a month due to the lockdown by the government.

how long to repay lsetf loan