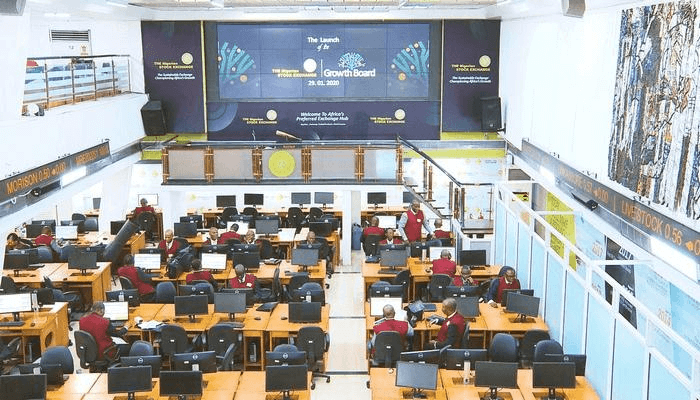

The Nigerian bourse sustained further losses as the week opened on a negative note. The All Shares Index / Market Capitalization fell by -2.02% to close at 20,669.38 and N10.771trillion respectively, bringing the year to date performance down by 19.73%.

However, the market witnessed improved turnover, as both volume and value traded rose by 42.98% and 38.60% respectively, at 336.43mn units of shares valued at N4.127bn in 4,184 deals.

First Bank Nigeria was the most traded stock by volume at 98.62 million units, followed by Guaranty Trust Bank with 55.65 million units of trades.

Two of the five indices under coverage declined, while three advanced. The Industrial Index (-7.23%) led the laggards, followed by the Oil & Gas Index (-4.93%). In contrast, the Banking, Insurance and Consumer Goods indices appreciated by +2.61%, +1.94%, and +0.55% respectively.

(READ MORE: Bears return ASI down 0.13% as trading volumes plunge)

Significant depreciation in BUACEMENT (-9.92%), and DANGCEMENT (-6.40%) dragged the Industrial Index lower, while sell-offs in SEPLAT (- 9.99%) weighed down the Oil & Gas Index.

On the flip side, ACCESS (+9.92%), FIDELITY (+8.28%) and ETI (+2.56%) propelled the Lenders Index upward, while the Insurance and Consumer Goods Indices was boosted by gains in AIICO (+9.59%), WAPIC (+7.69%), and FLOUR MILL (+4.88%).

Top gainers

ACCESS up 9.92% to close at N6.65; WAPCO up 9.50% to close at N9.8; FLOUR MILL up 4.88% to close at N21.5; GUARANTY up 1.42% to close at N17.85, and NB up 0.91% to close at N22.2.

Top Losers

NAHCO down 10.00% to close at N2.34; SEPLAT down 9.99% to close at N490.1; BUACEMENT down 9.92% to close at N31.8,BOCGAS down 9.88% to close at N3.65, and DANGCEM down 6.40% to close at N117.