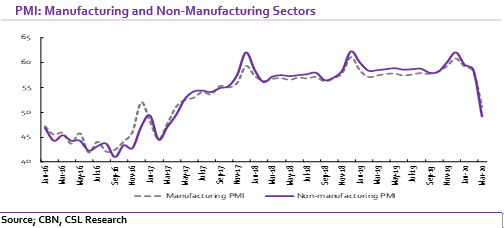

According to the Purchasing Managers Index (PMI) data released by the Central bank of Nigeria (CBN) for the month of March, activity level declined drastically as both the Manufacturing and Non-manufacturing PMIs slumped to 51.1 and 49.2 points from their respective readings of 58.3 and 58.6 in February.

Notably, both the Manufacturing PMI and Non-manufacturing PMI fell to levels last seen in April 2017, representing a 34-month low.

We believe the sharp decline witnessed in the sectors is due to the disruption of economic activities brought about by the outbreak of COVID-19. The virus has affected global supply chains as countries across the globe have implemented a total lockdown and restricted cross border movement of people as well as goods and services. This has resulted in the shut down of factories as manufacturers can no longer import raw materials required for production even as demand from customers remains constrained by the “stay at home” policy amidst loss of jobs.

The data further revealed that, of the 14 surveyed subsectors in the manufacturing sector, seven sectors recorded declines, reflective of broad-based steep declines in all of the five major indices; Employment level (-9.3), Raw materials/WIP Inventory (-9.1), Supplier delivery time (-9.0), New orders (-6.8) and Production level (-4.5) used in gauging the manufacturing sector.

The data further revealed that, of the 14 surveyed subsectors in the manufacturing sector, seven sectors recorded declines, reflective of broad-based steep declines in all of the five major indices; Employment level (-9.3), Raw materials/WIP Inventory (-9.1), Supplier delivery time (-9.0), New orders (-6.8) and Production level (-4.5) used in gauging the manufacturing sector.

Like the manufacturing-PMI, the non-manufacturing PMI also showed steep declines across the four key metrics; Business Activity (59.3 to 52.2), Inventory level (58.6 to 49.6), Level of new orders (58.8 to 47.8), and Employment level (57.8 to 47.3) used in gauging activity level. Notably, Utilities (-25.0), Transportation & warehousing (-18.6) and Repair, Maintenance/Washing Of Motor Vehicles (-15.4) were the worst hit, reflective of the dampening effect of subdued economic activities and restriction on movement of people and goods and services.

[READ MORE: Crude Oil: Unsold cargoes forces price slash)

With the epicentre of economic activities (Lagos) in the country on the verge of a complete lockdown, we expect activities to remain downbeat in both sectors in the short term.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.

I want to fill the form

Abdullahi