In what can be regarded as an unexpected yet positive move, the Central Bank of Nigeria (CBN) on Friday moved the official exchange rate from N307/US$1 to N360/US$1.

At the Investors and Exporters Window (I & E), the CBN also adjusted the NGN peg upwards by 5.7%, as it raised its intervention rate to N380 from N366. From a theoretical perspective, this implies a devaluation of the local currency, however, the Governor of the apex bank refuted this claim, noting that the action was an adjustment of price and not a devaluation of the currency.

We highlight that the CBN issued a letter to banks and Bureau De Change Operators (BDCs) informing them of the new exchange rate for dollars from the International Money Transfer Operators (IMTOs).

READ MORE: Coronavirus: CBN advises Nigerians to go cashless ahead deadline

According to the CBN, IMTOs will sell to banks at N376/US$1 while banks will sell to the CBN at N377/US$1. The CBN will sell to BDCs at N378/US$1 while the BDCís will sell to end-users at “no more than” N380/US$1.

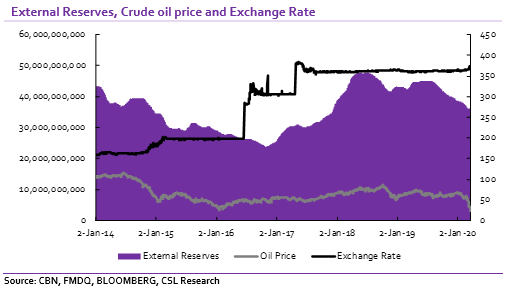

We believe the decision of the apex bank is in response to weakening external conditions, following the outbreak of COVID-19 and the sharp downturn in crude oil prices, which has accelerated capital flow reversals and increased fears of an impending devaluation in the local currency.

Although the CBN has maintained the position that a devaluation would be considered if reserves fall below U$30bn, we think the U-turn made by the apex bank was informed by the necessity to align the exchange rates across the various windows with prevailing market conditions in order to stem speculative activities.

With oil prices trading at sub US$30 levels, the ability of the CBN to defend the local currency using the FX Reserves external reserves (which has declined to a 29-month low of US$35.2bn as of 19 March) is doubtful. With this development, we anticipate there would be lower pressures on the bank’s FX reserves as the weakening of the local currency raises the attractiveness of carry trade.

READ MORE: OFFICIAL: BankS charge N368 per dollar for debit card transactions

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.