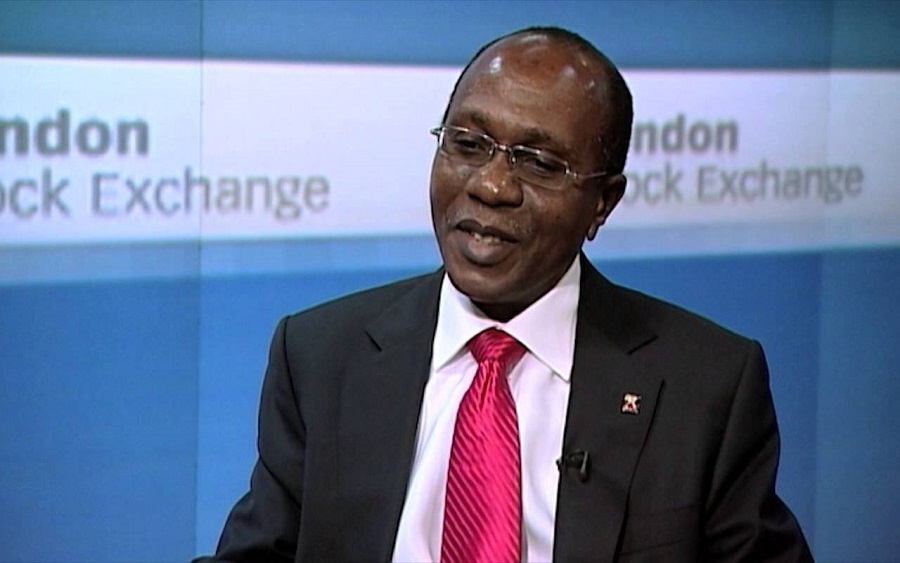

Central Bank of Nigeria has disclosed that the apex bank would support critical sectors of the economy with N1.1 trillion intervention fund. This was stated by the Godwin Emefiele, Governor of the apex bank on Wednesday in a statement.

In the statement, Emefiele explained that out of the N1.1trillion, about N1trillion would be used to support the local manufacturing sector as well as boost import substitution.

READ MORE: CBN insists on no devaluation, threatens to sanction those responsible for false speculations

He added that the balance of N100 billion would be used to support the Health Authorities to ensure laboratories, researchers and innovators work with global scientists to patent and produce vaccines and test kits in Nigeria.

This, he said, was imperative following the Coronavirus pandemic, adding that the N100bn would enable the country prepare for any major crises ahead.

He said given the continuing impact of the disease on global supply chains, the CBN will increase its intervention in boosting the economy.

He said, “First the CBN is directing all Deposit Money Banks to increase their support to the pharmaceutical and healthcare industries.

“In local drug manufacturing, in increased bed count in hospitals across Nigeria, in funding intensive care as well as in training, laboratory testing, equipment and R&D.

“In addition to the N50bn soft loans to small businesses already announced, the CBN will increase its intervention by another N100bn in loans this year to support health authorities.

“Secondly, given the continuing impact of the disease on global supply chains, the CBN will increase its intervention in boosting local manufacturing and import substitution by another N1tn across all critical sectors of the economy.”

He said the management of the apex bank will meet with the Bankers Committee this Saturday at 10.00 am to work out the modalities for the intervention.

“Central Bank of Nigeria has disclosed that the apex bank would support critical sectors of the economy with N1.1 trillion intervention fund. This was stated by the Godwin Emefiele, Governor of the apex bank on Wednesday in a statement.“

N1.1 trillion intervention fund without good road infrastructure will not make any difference in the critical sectors of the economy.

What will support critical sectors of the economy are:-

< Good road connectivity

< Security of person and property

< Working institutions, for example, the judiciary.

A very good development