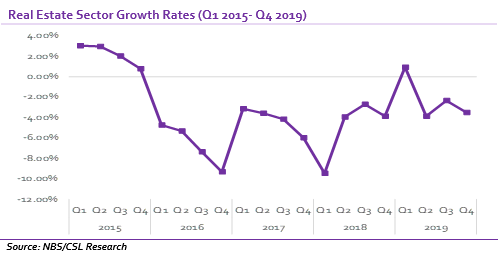

The latest Gross Domestic Product (GDP) report for 2019 revealed that the real estate sector posted a negative growth of 2.36% albeit lower than the negative 4.74% reported in 2018. We highlight that the real estate sector was one of the hard hit sectors during the 2016 recession, shrinking by 6.86% in 2016.

Since then, however, the performance of the real estate sector has been lacklustre with the sector recording just one positive growth (0.93% in Q1 2019) over the past 16 quarters (Q1 2016-Q4 2019).

In our view, the chief contributor to the uninspiring performance in the sector is weak disposable income among consumers, which continues to undermine the demand for housing. GDP growth over the last three years (2017; 0.8%, 2018; 1.91% and 2020; 2.27%) has remained below population growth of c.2.6%, implying declining per capita income.

The weak demand for housing is evident in the growing number of unoccupied houses in high-brow locations across the country, particularly in Lagos and Abuja. Accordingly, real estate developers have been unable to recover their investments in existing properties, a condition that has hindered further capital spending in new properties and buildings.

[READ MORE: Driving tax revenue growth)

Asides weak disposal income, high interest rates which makes mortgage financing unattractive, poor regulations guiding land use and registration as well as the rising cost of acquiring building materials are key factors that deter private sector investments.

In our view, a key catalyst to drive growth in the real estate sector will be to increase consumer income and consequently drive housing demand through increased productivity and enhanced employment opportunities.

In addition, reforms and policies geared towards removing the structural bottlenecks (land use permits, property registration, acquisition of certificate of ownership etc) stifling the growth of the sector will help in enhancing private sector investments.

Finally, available of mortgages at attractive interest rates will also go a long way to stimulate demand for housing.

________________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.