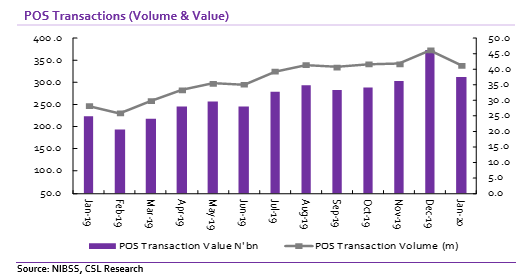

According to data published by the Nigerian Inter-Bank Settlement System (NIBSS), volume and value of PoS transactions grew 46.7% y/y and 40.6% y/y to 41.3 million transactions and N313.4 billion respectively in Jan 2020. However, on a q/q basis, volume and value of POS transactions declined 10.5% and 15.9% q/q from December 2019’s figures.

In addition, volume and value of mobile payments increased 914.5% and 396.6% y/y to 7.4 million transactions and N133.2 billion but declined 10.7% and 10.6% q/q respectively. We note that the decline in January 2020 relative to December 2019 was expected as transactional activities usually receive a boost from spending associated with the festive period.

In our view, the robust y/y growth was driven by greater adoption of digital platforms among the populace and increased investments by players within the sector.

We recall the Federal government raised VAT and introduced stamp duty charges of N50 per N1,000 transaction value carried out via PoS terminals in Q4 2019. We expected this to impact on the willingness of Nigerian consumers to use POS terminals but this was later revised by the CBN to N50 on a minimum of N10,000 transaction value.

[READ MORE: Bank’s lending rates decline albeit slower than expected)

We think the decision of the apex bank helped in sustaining the gains recorded in the sector. We note that the aggressive expansion embarked upon by key players including Banks and fintech players has contributed to the growth in digital payments. Banks and regulators likewise have increased awareness of these alternate digital payments platforms particularly in rural areas as part of the financial inclusion drive. PoS terminals availability has continued to improve with POS terminals deployed growing 37.3% y/y to 306,409 terminals.

As we highlighted in our FINTECH thematic report (The Nigerian Fintech Industry; the growth frontier of the new decade – 9 Jan 2020), we believe Nigeria’s growth frontier for the next decade is the digital payment & lending business.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.