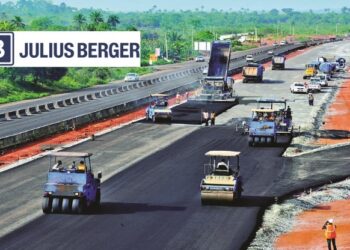

In a public disclosure that was sent to the Nigerian Stock Exchange yesterday, Julius Berger Nigeria Plc said its closed period would commence from today, ahead of the company’s plan to release its audited 2019 financial statement.

The closed period is in line with the listing rules of the NSE, as well as provisions by the Securities and Exchange Communication and the Company and Allied Matters Act.

Note that the closed period is expected to last until twenty-four hours after the company’s audited 2019 financial statement is released to the public. During the duration period, anyone with insider knowledge about the company and all its subsidiaries, are prohibited from trading in the company’s stock.

The stock opened trading today on the NSE at N22.40.

In the meantime, Julius Berger’s audit committee members are scheduled to meet between March 10th and 11th to approve the audited 2019 financial statement.

[READ MORE: Seplat Petroleum announces closed period, as directors meet on March 19th)

Meanwhile, in a related development, Nigerian Breweries Plc earlier today announced the 22nd of April, 2020 as the date for its 74th annual general meeting (AGM).

The AGM, which will hold in Lagos at Shell Nigeria Hall, Muson Centre, will be used to deliberate on a number of important issues, including deliberations on the company’s audited financial statement for the year 2019, as well as the proposed dividend payment. The company’s shareholders shall also be deliberating on some special business.

A statement from the company disclosed that the shareholders shall also be considering whether or not to pass a resolution which said:

“That the general mandate given to the company to enter into recurrent transactions with related parties for the company’s day-to-day operations, including amongst others the procurement of goods and services, on normal commercial terms be and is hereby renewed.”

Still on financial statements, Sterling Bank also announced yesterday, through a public disclosure to the NSE, that its board of directors recently met to approve the company’s audited financial statement. Details of the audited result will be communicated to the public as soon as the Central Bank of Nigeria is done reviewing it, the company said.

READ ALSO: Sterling Bank dedicates 10% loan portfolio to supporting agriculture

The board of Ardova Plc (formerly Forte Oil Plc) also met and approved the company’s audited 2019 financial statement. The document will be filed with the NSE latest by Friday, February 28th, 2019.