The Central Bank of Nigeria (CBN) has injected $218.41 million into the inter-bank retail Secondary Market Intervention Sales (SMIS).

The dollar-denominated intervention, which is meant for only agricultural and raw materials sectors, is in continuation of its intervention in the inter-bank foreign exchange market.

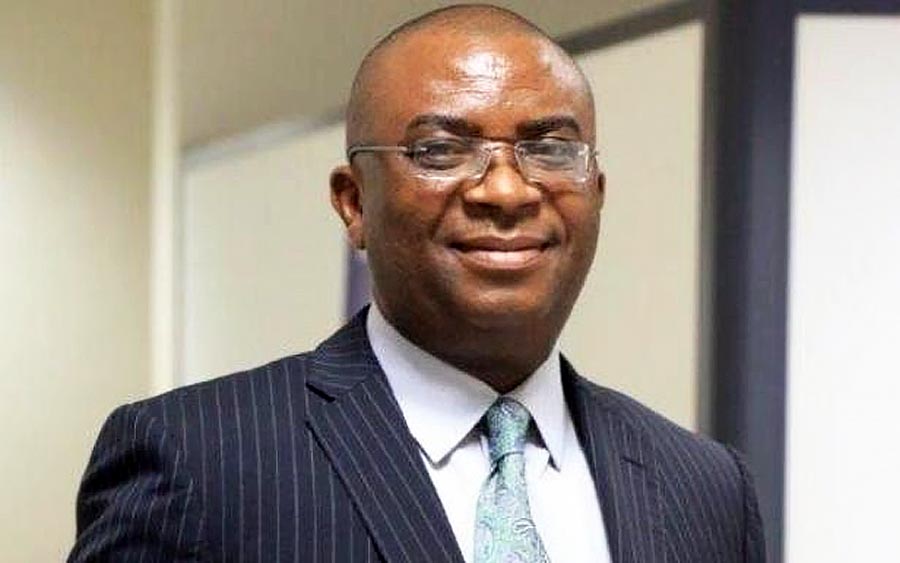

According to the CBN Director of Corporate Communications, Isaac Okorafor, the exercise, just like in previous times, was for the payment of Renminbi-denominated letters of credit for agriculture as well as raw materials.

Okorafor explained that the stability of the foreign exchange was largely due to the sustained interventions by the bank.

Speaking further, he assured that the CBN Management would remain committed to ensuring that all the sectors of the forex market continue to enjoy access to the needed foreign exchange, stressing that the stability in the foreign exchange market continued to attract investors.

[READ MORE: Hurdles before CBN, as ABP beneficiaries fail to repay loan)

The Nation reported, last week, the CBN had offered authorised dealers in the wholesale segment of the market the sum of $100 million while the Small and Medium Enterprises (SMEs) and the invisibles segments received the sum of $55 million each.

Currently, a dollar is exchanged for N358 at Bureau de Change (BDC) segment of the foreign exchange market while CNY 1 exchanged for N46 as at Friday.

Recall that in May 2018, Nigeria and China finalised a currency swap deal. The swap deal was to ensure ease of doing business between both countries. The deal was signed by CBN Governor, Godwin Emefiele on behalf of Nigeria while PBOC Governor, Yi Gang signed on behalf of China.

Why the deal matters: For the CBN, it will reduce pressure on the nation’s foreign reserves. Nigeria imports a huge proportion of both finished goods and raw materials.

On the other hand, China has increasingly taken steps to position the Yuan as a reserve currency. A reserve currency is a currency widely used in international trade that a central bank holds as part of its foreign reserves. The US dollar is the major reserve currency in the world.