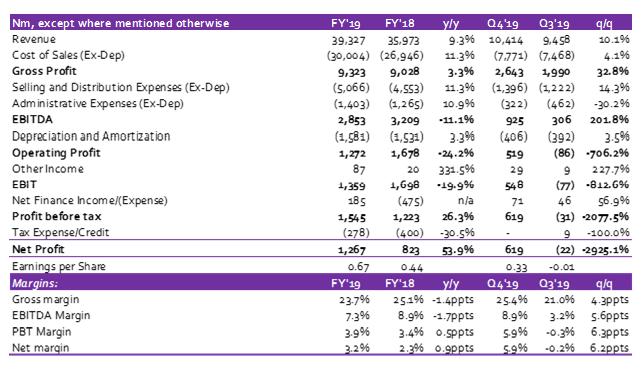

Cadbury has published its UNAUDITED FY 2019 results announcing a 9.3% y/y increase in Revenue to N39.3bn in FY 2019 from N36.0bn in FY 2018.

Furthermore, Revenue within the quarter recovered, growing 10.1% q/q to N10.4bn in Q4 2019. Reported Revenue came in higher than our estimate of N38.9bn by 1.2%.

Revenue growth continues to be driven by broad-based recovery in Refreshment Beverages (+8.3% y/y) and Confectioneries (+20.5% y/y) while Intermediate Cocoa Products (-7.2% y/y) continues to lag.

Cost of Sales (ex-depreciation) grew faster than revenue, up 11.3% y/y to N30.0bn in FY 2019 from N26.9bn in FY 2018. Though Gross Profit increased 3.3% y/y to N9.3bn in FY 2019 from N9.0bn in FY 2018, Gross margin weakened, down 1.4ppts y/y to 23.7% in FY 2019 from 25.1% in FY 2018. We believe pressure from higher Cocoa & Sugar prices impacted margins during the year.

Operating Expenses (adjusted for depreciation) recorded a sub-inflationary growth of 11.2% y/y to N6.5bn in FY 2019 from N5.8bn in FY 2018. The increase in Operating Expenses was driven by an 11.3% y/y increase in Selling & Distribution Expenses (adjusted for depreciation) to N5.1bn in FY 2019 from N4.6bn in FY 2018 and a 10.9% increase in Administrative Expenses (adjusted for depreciation) to N1.4bn.

Against this backdrop, EBITDA declined by 11.1% y/y to N2.9bn in FY 2019 from N3.2bn in FY 2018. We note the recovery in Q4 EBITDA, up 201.8% q/q to N0.9bn from a rather dismal performance in Q3.

[READ MORE: Fidelity Bank reports a 28.5% increase in profit for FY 2019)

Depreciation & Amortisation grew 3.3% y/y to N1.6bn in FY 2019. The increase in Depreciation & Amortisation, as well as decline in EBITDA, pressured Operating profit (down 24.2% y/y to N1.3bn) & EBIT (down 19.9% y/y to N1.4bn). However, improved financial leverage, as well as lower effective tax rate (down 14.7ppts y/y to 18.0%), provided a boost to Cadbury’s Profits as the company recorded a Net Finance Income of N185.3m in FY 2019 as against Net Finance Expense of N475.5m in FY 2018.

Consequently, Profit before Tax jumped 26.3% y/y to N1.5bn in FY 2019 from N1.2bn recorded in FY 2018 while Net income was higher, up 53.9% y/y to N1.3bn in FY 2019 from N823.1m in FY 2018. We note reported Net income beat our projection of N952.4m on the back of lower effective tax rate. Earnings per Share printed at N0.67/s (CSL Estimate – N0.51/s) in FY 2019 compared to N0.44/s in FY 2018

We have a HOLD recommendation on the stock with a target price of N12.77/s.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.