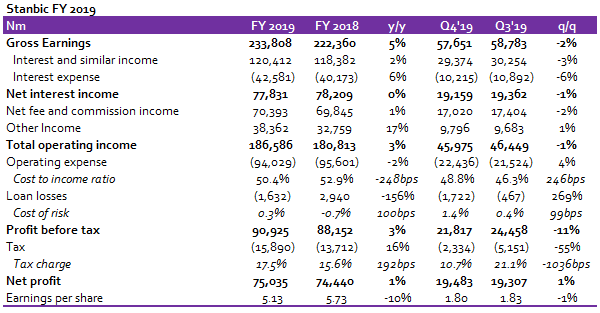

Stanbic recently released its FY 2019 UNAUDITED results wherein Gross Earnings grew 5% y/y growth to N233.8 billion, slightly below our 2019 estimate of N234.2 billion. Profit before tax also increased 3% y/y to N90.9 billion, in line with our FY 2019 estimate of N90.4 billion. On a q/q basis however, gross earnings declined marginally, down 2% q/q to N57.7 billion while Profit before tax fell 11% q/q to N21.8 billion.

Interest Income grew marginally, up 2% y/y to N120.4 billion in FY 2019 but declined 3% q/q to N29.4 billion. The growth in Interest Income was driven by growth in the loan book (Net loans to customers grew 23% y/y in 2019). We highlight that the growth in the bank’s loan book is the highest since 2014; 40.6%.

Accordingly, we believe the strong growth was on the back of CBN’s guideline which mandated banks to maintain an LDR of 65% by December 2019. As of 9M 2019, the bank’s Loan to funding ratio stood at 62.9%.

Interest Expense, however, rose 6% y/y to N42.3 billion in FY2019 but declined 6% q/q to N10.9 billion. The rise in Interest expense compared to the growth in Interest Income ensured Net Interest Income remain flat, both on a y/y basis and q/q basis.

Non-Interest Income grew 6% y/y to N108.8 billion but declined marginally by 1% q/q to N26.8 billion. The y/y growth was driven largely by the increase in Trading Income (up 16% y/y) amidst the flattish growth in Net Fee and Commission Income (up 1% y/y). However, the quarterly decline was due to weaker Net Fee and Commission Income (down 2% q/q) as well as lower Trading Income (down 5% q/q) – we attribute this to lower yields on risk free instruments during the quarter.

[READ MORE: Equities: Foreign investors remain net sellers for second consecutive year)

Unlike in 2018 when the bank recorded writebacks of N2.9 billion, the bank had Impairment Charge of N1.6bn, brining cost of risk to a minimal 0.3% for FY 2019.

Operating income grew modestly, up 3% y/y to N186.6 billion but was slightly pressured in Q4 (down 1% y/y)- Again, we suspect this was due to the lower yield environment.

Cost efficiencies, however, remained firm as Operating Expenses declined 2% y/y but grew at a sub-inflationary rate of 4% in Q4 compared with Q3. The decline in OPEX coupled with a single-digit growth in Operating Income (+3% y/y) led to a 248bps improvement in Cost to Income Ratio (CIR ex provisions) to 50.4%.

Pre-tax Profit grew 3% y/y to N90.9bn, largely on account of stronger Trading Income and moderation in OPEX. On a quarterly basis, however, Pre-tax Profit fell 11% q/q to N21.8bn. Profit after tax grew marginally 1% y/y to N75.0bn, owing to higher effective tax rate of 17.5% compared to 15.6% in FY 2018. RoAE stood at 27.3% in FY 2019 compared to 34.5% in FY 2018.

We have a target price of N55.01/s for Stanbic (current price: N41.5) with a BUY recommendation.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.