Ahead of the FY 2019 earnings season, companies within the FMCG space have decried the negative impact of the August border closure on their businesses. We recall that in August, the Presidency announced the closure of Nigerian land borders, a move that hindered the free movement of goods across the land borders.

The aim was to ensure compliance with ECOWAS protocol on transit of goods, protect local industries, tackle insecurity and curb influx of smuggled goods. However, local companies are beginning to feel the negative impact of the closure rather than benefits.

In particular, access to raw materials for manufacturers of cocoa beverages has become more difficult. Prior to the closure of the border, cocoa beverage manufacturers imported cocoa from neighbouring countries like Ghana through trucks via the land borders rather than through the seaports.

However, the closure of the border has forced them to move their raw materials through the seaports which according to them makes freight more expensive. Additionally, raw materials take longer time to reach factories thus increasing production lead time.

Furthermore, FMCGs with strong export operations have seen their export activities significantly affected as they can no longer push goods through the land borders to the West African markets where they have core export operations.

[READ MORE: Crude Oil: Nigeria’s oil production slips for the third consecutive month)

Essentially, they are required to pass through the seaports which makes distribution cost more expensive, while delivery time takes longer. Accordingly, importing and exporting goods via the seaports has exposed more FMCGs to the Apapa menace.

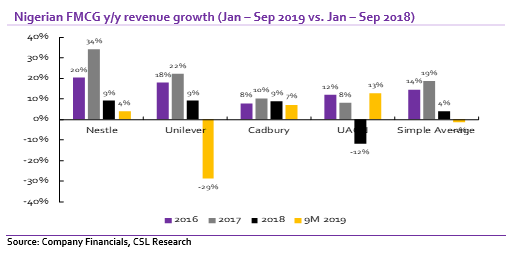

In our view, the border closure will feed into their Q4 2019 earnings scorecards in the form of pressured revenue, higher production cost and higher distribution cost. While we note that the percentage of export revenue to total revenue for local FMCGs is not significant, the fact that domestic consumption is still significantly pressured makes the situation worse for FMCGs.

________________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.

While I agree that the temporary border closure may have some unwanted impact on some businesses, I still think it’s a good decision by the Fed govt. The affected organizations should seek for innovative ways to mitigate the impact on their businesses and maybe even create new opportunities in the process, rather than trying to attribute their poor performance and ineptitude to the policy.