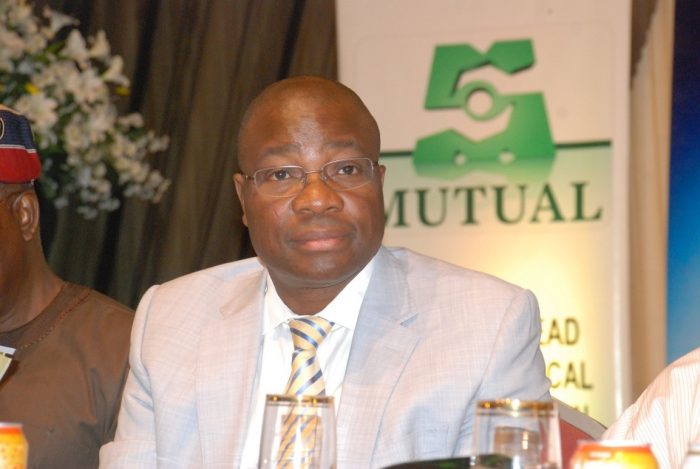

Chairman, Mutual Benefits Assurance, Akin Ogunbiyi, has criticised the on-going recapitalisation exercise in the insurance industry describing it as the greatest de-service to the firms and industry.

What it implies: Ogunbiyi said the exercise has created confidence problem in the industry as it could kill the industry if it is not reversed or given a longer-term period as deadline.

He said, “In fact, something drastic needs to be done to reverse this new capital exercise. It has created a lot of confidence problems.

“Even the people doing insurance don’t know what will happen. If an industry is working with N5bn and they are not able to use it for profitability, and you say increase it to N18bn, what are we insuring?

[READ MORE: Mutual Benefits to raise N2 billion after breaking dividend drought(Opens in a new browser tab)]

“Government should hear it from me; it is killing the industry. If nothing is done quickly, either to reverse this or to give a three-year or long-term period for the recapitalisation, the industry is gone. Today, the insured doesn’t even know what to do. I can tell you that only five insurance companies have passed that recapitalisation stage out of 49 companies. Is that the kind of industry that we want.”

On Government`s participation, Ogunbiyi argued that while the government is pushing for recapitalisation, it not patronising the insurance companies like it’s partnering with the commercial banks.

“What is the capacity that five of them will have to absolve the risks that we have currently, where the informal sector is not part of the risk you are taking? It is only the corporate world. And you say people should move from N2billion to N8billion, and from N3billion to N10billion capital base. How much is the capital base of banks? N25billion? The government will pass the budget; everything goes through the commercial banks but we don’t have government patronage in insurance.

“At the current capital base, the industry has the capacity to absolve any risk the government would give. At N3billion, the Nigerian insurance industry is the most capitalised within the African continent. For countries with a higher contribution to Gross Domestic Product in Africa, what are the capital requirements they are operating with? Why is it that the only solution the government has for insurance companies is to increase capital?”

[READ MORE: Mutual Benefits to raise N2 billion after breaking dividend drought(Opens in a new browser tab)]

Nigeria’s economy not favourable: With the Nigerian economy growing slowly, Ogunbiyi said the market isn’t favourable for firms operating in Nigeria. Despite a population of about 200 million, insurance penetration is still below 0.5 per cent in Nigeria,” he said.

To bultress his point, Ogunbiyi said insurance companies on the Nigerian Stock Exchange(NSE) have become penny stock in the capital market as their values are as low as 50kobo.

“They will succeed in killing this industry. When you say companies should increase capital, is it in an economy that is not growing? Where are the productive sectors of the economy? Where is trade, where is the government? Everybody is barely surviving; nobody is thinking of insurance and you wake up to say

2 / 2

go to N18bn. Insurance companies have become penny stock on the stock market. How many insurance companies have paid dividend in the last 10 years? Where are the investors that will bring in the money?”

Foreigners buying firms with peanut: The Mutual Benefit Chair alleged that insurance companies are being acquired with peanuts by foreigners and the owners don’t last more than two years before they exit the market.

Ogunbiyi said his frustration isn’t because of Mutual Benefits, because his company is strong enough to survive any level of capital base demanded by the government, he, however, is more concerned about the market that could lose about 10 companies while only one could recapitalise.

“How do you take people’s sweat because of this issue of recapitalisation and give to the foreigners? I don’t know whether the policymakers have compromised. Foreigners are buying the insurance companies for peanut.

[READ MORE: Mutual Benefits to raise N2 billion after breaking dividend drought(Opens in a new browser tab)]

“They are not doing what they call direct foreign investment. They are bringing flight by night. Check all the history of those who have bought into insurance in Nigeria; they operate it for two years, they create the hype, manipulate the prices, move it up, two years they are off. This service is a total de-service, not only to insurance but even to the national economy.

“If you have one insurance company that is able to recapitalise, will that take the place of 10 that will not survive. If they make the capital N200bn, Mutual Benefits will survive. But it is not about Mutual Benefits, it is about the industry that is dying. This policy will kill the industry if the government does not quickly rise up. This is a retrogressive move. Capital base is not the only way to make insurance create value and to make it more relevant to the national economy,” he told Punch.