Despite the food inflation that has slightly accelerated over the past two months, which is affecting the purchasing power of Nigerians, analysts in EFH Hermes Research indicate that Nestle Nigeria Plc (NN) remains a major stock to watch in the Consumer segment of the Nigerian Stock Exchange.

With further competition that would impact margins and significantly increase Capital Expenditure (capex), Nestle’s returns are expected to remain strong and well above its Weighted Average Cost of Capital (WACC), Returns on Equity as it would continue generating value over the coming years.

The research firm’s expectations is not a mirage as they are tied to certain key drivers that are believed gave the conglomerate an edge over its counterparts. They are:

Products and targets

EFG Hermes argued that NN is less exposed to impulsive or non-discretionary consumption than its peer, which provides some defences to its top line, as all its products can be considered ‘everyday’ products (Milo ready-to-drink). In contrast, Unilever has a household & personal care segment, which are not necessarily purchased every day. Also, Cadbury has impulse products in its portfolio (Clorets, TomTom).

[READ MORE: Kwikmoney changes name again, raises $20 million in series B funding (Opens in a new browser tab)]

Raw materials

As of Full Year 2018, over 80% of NN’s raw & packaging materials were sourced domestically and the company still plans to increase this by the end of 2019. EFH Hermes see the development as a comparative advantage relative to peers. For instance, 55% of Unilever Nigeria’s raw materials are imported. Though sourcing raw materials locally does not totally eliminate its foreign exchange (FX) risks, it allows NN to be less susceptible to FX shocks.

Proximity to shoppers

According to the research firm, proximity to consumers and giving access to products to the vast majority of the population are some of the key drivers of NN’s top-line growth. “The number of NN product’s distributors continues to grow Year-on-Year (Y-o-Y). By the end of 2018, NN had 121 key distributors, which is 20% more than Unilever Nigeria and more than the double that of Cadbury,” the report stated.

Strong brand equity, affordable prices

The firm also argued that NN enjoys brand loyalty across the nation as it derives from its global brand and remain affordable to the mass market. Consumers get access to a premium brand that is not more expensive than its direct peers. For example, Maggi Chicken (400g) is priced at a 25% discount to its major competitor, Knorr Chicken (400g) for the same packaging & size.

Innovation with low

Considering how Nigerians like to try new products, the company’s portfolio continues to evolve, adapting to the dynamic needs of consumers in the Nigerian market. Between 2017 and 2019, NN launched Maggi Naija Pot, Milo ready-to-drink beverage, Golden Morn Puffs and Maggi Signature.

Returns

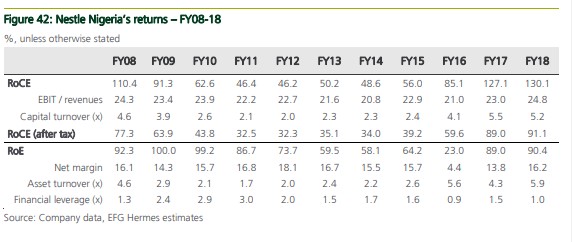

Despite having paid out roughly 80% of its cumulative net profit generated over the past 10 years in dividends (roughly N173 billion dividends outflow vs. N221 billions of net profit), EFG Hermes believe NN has been able to keep its Balance Sheet solid and at the end of FY 18 it had a net cash position.

According to the report, the recent significant increase in NN returns is explained by the strong operating margin (its Selling, General and Administrative Expense, SG&A as a % of sales has been higher than at Unilever Nigeria, but it is compensated by a higher GM and lower depreciation as a % of sales); high capital turnover (capex has been low over the past few years, which means that sales have been generated through a very stable asset base, a significant portion of the assets have already been depreciated; and net finance expenses were low (as the company is net cash and did not book any significant FX loss in FY18).

[READ MORE: EFG Hermes seals Helios Towers’ £288 million IPO on LSE]

Ratings

EFG report stated, “We initiate coverage NN, the leading food and Drinks Company in Nigeria, with a Neutral rating. We see NN as fairly valued on our Discounted Cash Flow-driven (DCF) TP of N1,485, which implies 24x FY20e P/E, and when analysing other metrics like Free Cash Flow (FCF) yield, Price Earning (P/E), and Price Earning Growth (PEG).

“In addition, recent weak result trends, a lack of clear catalysts, and macro risks more skewed to the downside (i.e. devaluation) will weigh on the stock’s upside performance, in our view. Nevertheless, we believe NN is a high-quality company with great products (Maggi stocks and Milo are leading brands in Nigeria), competitive pricing, and strong brand value, which will drive its outperformance among peers.”