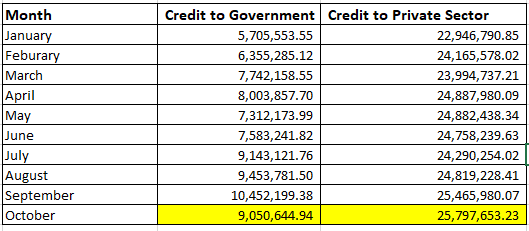

…as loans to the private sector hit N25.79 trillion

Bank loans to the government dropped by N1.4 trillion in October as it dropped from N10.45 trillion in September to N9.05 trillion, the latest credit and money statistics report of the Central Bank of Nigeria (CBN) revealed.

The report also disclosed that the credit given by the financial institutions grew from N25.465 trillion to N25.797 trillion within the same period.

Credit to the private sector had steadily been on the rise in 2019, opening the year at N22.95 trillion and now stands at N25.79 trillion. Banking sector credit to the private sector initially rose by 2.61% to N25.47 trillion in September from N24.82 trillion in August.

This recent upward movement can be attributed to the policy of the Central Bank mandating banks to increase lending to the real sector of the economy.

Breakdown of Credit to government and private sector

- In January, credit to private sector stood at N22.9 trillion while credit to government stood at N5.7 trillion

- February saw an 5% increase in credit to private sector to N24.6 trillion and an 11% increase in credit to government to N6.3 trillion

- In March and April, credit to private sector declined by 1% and grew by 4% respectively while credit to government grew highest so far by 22% and 3% respectively for the same period

- Credit to private sector experienced a decline of N5.5 billion from between April and May while credit to the government also recorded a decline of 9% within the same period

- In July credit to private sector dropped to N24.2 trillion from N24.7 trillion and credit to government increased by 21% from N7.5 trillion in June

- In October credit to private sector marginally increased to N25.7 trillion and credit to government declined by 13% from N10.4 trillion recorded in September

Meanwhile, commercial bank lending to the real sector at N25.8 trillion represents a 12.42% increase since the beginning of 2019 and a year on year increase of 11.49%.

However, the decline of credit to the governments for two months back to back, from N9.45 trillion in August to N9.05 trillion in October could be attributed to single-digit yield on government securities and CBN policy to move Loan-to-Deposit from 60% to 65%.

Specifically, the interest rate for the 91-day tenor on Treasury bills towards the end of October dropped to 9.73% against its opening figure of 11.4%; the 182-day tenor tailed off to 11.02% compared to the 12.31% it commanded earlier, and things were not significantly different on the yield rate of the 364-day tenor which equally nosedived to 12.99% in October.

[READ MORE: Nigeria borrows fresh €500m from Credit Suisse, others, to finance industrialization]

Backstory: As earlier published by Nairametrics in July, the CBN had introduced the directive to increase loan-to-deposit ratio to 60%, encouraging commercial banks to do more of small and medium-sized enterprises, retail, mortgage, and consumer lending.

As published in September on Nairametrics, the Central Bank penalized lenders that fell short of the old 60% benchmark while increasing the Loan-to Deposit ratio to 65%, pressuring banks to increase lending to the real sector of the economy.

Implications: Single-digit interest rates will continue to discourage lending/credit to government, while the 65% Loan-to-Deposit ratio policy of the CBN will continue to drive commercial bank lending to the real sector upwards. The idea behind this is to stimulate growth and increase manufacturing activities within the Nigerian economy.