Access Bank Plc has announced the appointment of Dr Okey Nwuke and Mrs Ifeyinwa Osime as its Non-Executive Director and Independent Non-Executive Director respectively.

In a notification published on the website of the Nigerian Stock Exchange, the lender made it known that the appointments were subject to the approval of the Central Bank of Nigeria.

The bank, however, noted that the appointees’ wealth of experience would be a great addition to the existing mix on the Board.

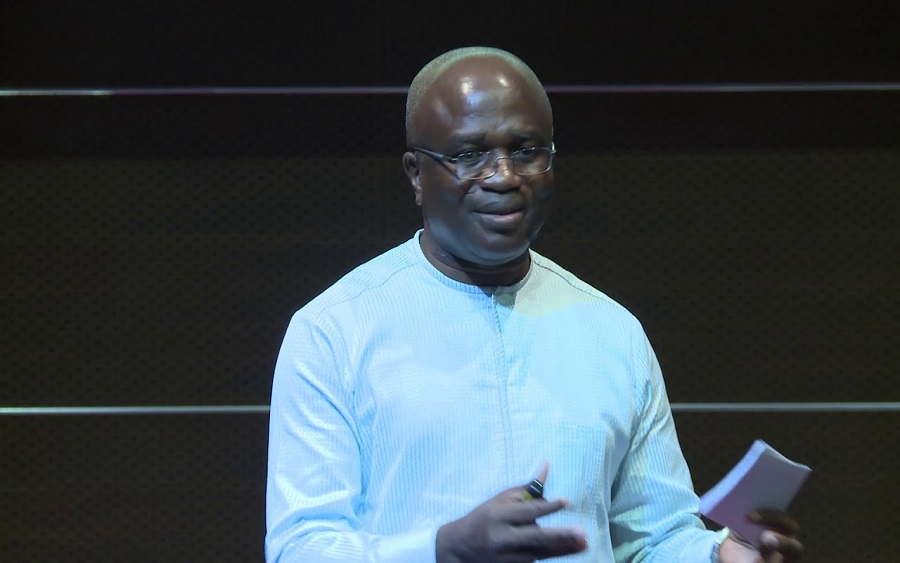

Nwuke’s Profile: Dr Okey Nwuke has over 28 years of experience in finance and corporate governance working with top corporates and leading commercial banks in Nigeria. He is a Fellow of both the Institute of Chartered Accountants of Nigeria (ICAN) and Chartered Institute of Taxation of Nigeria (CITN), an honorary member of Chartered Institute of Bankers of Nigeria (CIBN) and a member of Business Recovery and Insolvency Practitioners Association of Nigeria (BRIPAN).

He has considerable expertise in credit analysis and bank financial management through professional training as a chartered accountant and from relevant on the job training. Dr Nwuke is deeply versed in management of financial institutions having held Executive Director position in Access Bank from 2004 to 2013. He served as the Chairman of the Board of Directors of the Bank’s subsidiaries in Rwanda and Burundi and was a pioneer Non-Executive Director of StanbicIBTC Pension Managers Limited representing the Bank.

[READ MORE: Appointment of Dr. (Mrs.) Ajoritsedere Awosika, MFR as chairman of Access Bank Plc]

Dr Nwuke’s key competencies span across finance, strategy development and execution, organizational restructuring and transformation, leadership and change management. He joined the Board of Coscharis Group in August 2014 and is currently responsible for the strategic drive to position it for sustainability beyond the founder’s lifetime. He currently chairs the Shareholders’ Audit Committee of NASCON PLc.

He holds a B.Sc. Degree in Accountancy from University of Nigeria, Nsukka and an MBA (Distinction) in International Banking and Finance from the Birmingham Business School, United Kingdom. Dr Nwuke also holds a Doctorate Degree in Business Administration (DBA) from Walden University, Minnesota, USA with a research focus on leadership transition challenges in family businesses. He has been exposed to leadership and professional development programmes at globally renowned institutions.

Osime’s Profile: Mrs Ifeyinwa Osime is a versatile and result-oriented professional with over 30 years of experience in the insurance industry and commercial legal practice at management and board levels. She has deep knowledge and experience in the management of administrative, legal, and company secretarial functions in financial and other related institutions.

She had championed and established a special needs programme which is actively involved in the management and care of children and young people with special needs. She is currently a Partner at Macpherson Legal Practitioners, a Lagos-based law firm.

Mrs Osime is an Independent Non-Executive Director of WAPIC Insurance Plc and WAPIC Life ltd. She was the former Chairperson of PHB Healthcare Limited, former Director, Bank PHB Plc (now Keystone Bank Limited) and a former Director, Insurance PHB Limited (now KBL Insurance). She was the Company Secretary/Legal Adviser of African Development Insurance Company Limited (now NSIA Insurance) between 1989 and 1997.

She holds an LLM Degree from University of London (1989) with specialization in Corporate and Commercial Law and an LLB Degree from the University of Benin (1986). She is a member of the Institute of Directors and has attended several leadership and professional development programmes at globally renowned institutions.

[READ ALSO: Halima Dangote appointed to head Commercial Operations of Dangote Industries Limited]

While commenting on the appointments, the Chairman of the Access Bank, Mosun Belo-Olusoga, said the appointments were in line with the bank’s transformation phase. Nairametrics had earlier reported that Mrs Ajoritsedere Awosika would replace Belo-Olusoga as the Chairman of the bank in 2020.

“We are very delighted to welcome the new appointees to the Board of Access Bank. These individuals have been chosen based on their exceptionally rich, professional, academic and corporate board experiences which are all relevant to the needs of our Board.

“As we prepare for the next phase of our enterprise transformation, we continue to strengthen our board diversity. We are strongly convinced that their skills will no doubt add significant value to our quest to becoming Africa’s Gateway to the World,” Belo-Olusoga stated.