Imagine ten, twenty years from now how people will feel when they read about Buharinomics. Will they look back in disdain wondering how we allowed this to happen, or will they revel in glee thanking “the great leader” for laying the foundation for economic prosperity?

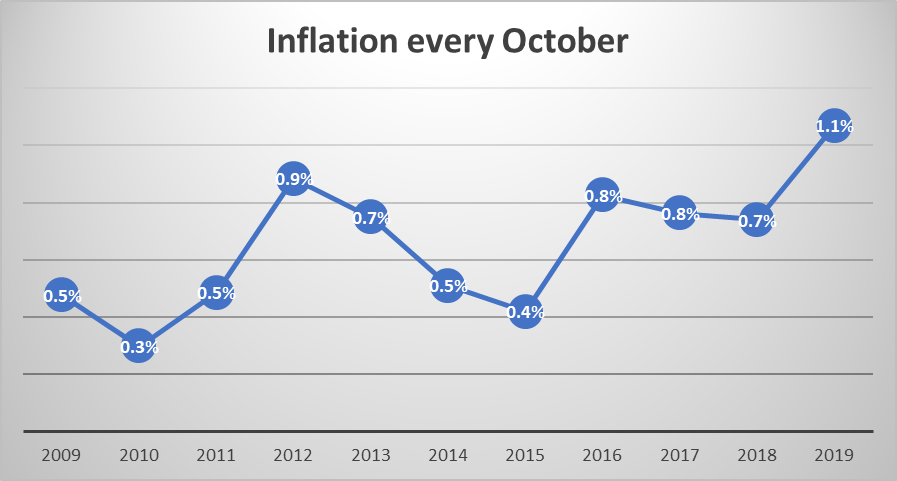

Unfortunately, we do not have a crystal ball and can’t determine history’s take on current events. What we can however do is analyse the latest installment of Buharinomics and its attendant effect on the economy. On Monday, the National Bureau of Statistics released its inflation report for the month of October. In no apparent surprise to naysayers and critics of the border closure, the inflation rate rose higher for only the third time since 2009 in the month of October, compared to September.

Nigerians have been delivered the sour taste of economic policies that are at the behest of a presidency determined to stimulate local production by any means necessary. For most analysts, the inflation rate for the month of October was rather telling. The report delivered a number of metrics that have now set the tone for how tumultuous the next few months could be for the Nigerian Economy. As they say, the devil is in the details.

Starting with the Consumer Price Index (General Inflation), we observed that October 2019 recorded the highest month on month rise in ten years at 1.1%. Food inflation was even worse. We recorded a month on month food inflation rate of 1.3% for October 2019. What about the Urban Inflation Index? It also fared worse at 1.15%, the worst we recorded in years. Everywhere you looked, the indicators were as bad.

Actually, most analysts expected the October inflation report to be bad and so perhaps this was not a surprise. With the attendant effect of the border closure still reverberating across the economy, it is only a matter of time before the numbers tell the stories. But October is bad not just because the numbers say so. It is bad because it is an indicator of where we are probably headed.

With the Christmas holidays just a few weeks away, holidaymakers will have to grapple with a higher cost of basic necessities such as food and clothing. After all, the Buharinomics expects belt-tightening for everyone outside of Aso Rock. Most companies are already reportedly cutting back on orders for Xmas gift items such as rice and groundnut oil. Some are going for much smaller bags to fulfill all righteousness (no pun intended). Annual holiday bonuses are also under threat for organisations hard it either side of the export/import ban

Where it probably hurts the most is with investing, especially in the stock and money markets. Investors are now faced with negative real returns going by the inflation rate of 11.6%. Last week, the CBN sold Treasury Bills at an average of 10%, meaning that investors now face zero returns on their naira if it is in the safe hands of the almighty CBN. The option would have been to buy OMO bills but that door has now been slammed shut.

The stock market looked like it could be the perfect option when stocks rallied briefly last week but a dead cat bounce surfaced on Monday as the stocks fell upon closing. Some investors are looking towards Eurobonds as a wise move. Earning 8% on the dollar seems wise these days if you are to believe that the single-digit greenback return is what Nigerian investors work so hard to earn.

October will surely be remembered for this disastrous inflation data by those living today even if history doesn’t. Chin up, this is just the beginning.