BusinessDay news report on Wednesday says the Senate Committee on Power is making attempts to resolve the rift between the Nigerian Electricity Regulatory Commission (NERC) and the electricity distribution companies (DisCos). NERC had on October 8, served notice to eight DisCos of its intention to cancel their licenses for failure to meet their obligated remittance to the market. According to the regulator, the DisCos had consistently failed to meet their remittance obligations to the market.

In Q1 2019, out of a total invoice of N190.1 billion issued to the DisCos from NBET, only a sum of N52.8 billion was paid. The disCos while not disputing their inability to meet cash obligations to NBET, noted that their inability to pay was due to NERC’s reluctance to raise tariffs to sustainable levels. The affected DisCos are Abuja, Benin, Enugu, Ikeja, Kaduna, Kano, Port Harcourt and Yola.

[READ MORE: Quick take: Higher OPEX, FX loss weigh on earnings]

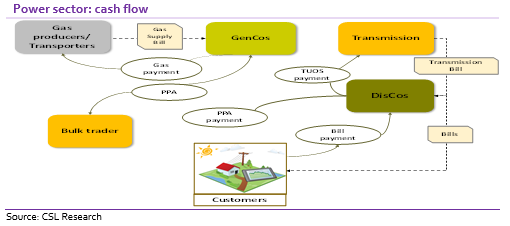

The current structure of the power sector is such that government-owned NBET buys electricity in bulk from generation companies through Power Purchase Agreements and sells to the DisCos, which then supply to the final consumers. NBET was incorporated in 2010 with a mandate to operate as the trading licensee holding a bulk purchase and resale licence.

It is responsible for buying and reselling electrical power and ancillary services from Independent Power Providers and from the Successor GenCos. It is not intended to exist in perpetuity in its current incarnation. Rather its role is to act as a broker between power producers and the discos until the market is mature enough to support commercial bi-lateral trading.

A major factor weighing on DisCos cash flows remains the artificially-low tariffs mandated by regulators. In 2016, power regulator Nigerian Electric Regulatory Commission (NERC) tried to implement cost-reflective tariffs proposing a 45% hike, following which labour unions took it to court. Consequently, tariff hike plans have been on hold since then.

[READ ALSO: Quick take: Growth slows in Q3 as profit misses estimates]

The argument by those against a hike was that, given persistent inflationary pressures on households and shrinking consumer wallets, it would have been unreasonable to introduce tariff hikes. Many also argue that they will like to see an improvement in power supply to households before they can agree to further tariff hikes.

______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.