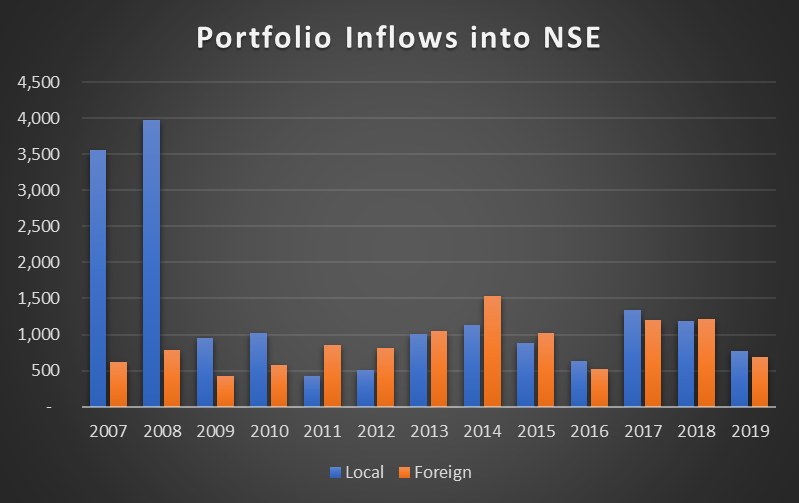

The latest data from the Nigerian Stock Exchange reveal transactions from local investors on the Stock Exchange 2019 year to date is about N775 billion, compared to foreign investor participation of about N689 billion. Local and foreign investor activities in the stock market are projected to fall short of N1.1 trillion and N1.2 trillion recorded in 2018 respectively.

Positively Correlated: Whenever there is a rise in local and foreign investor participation the All Share Index ended the year positively. The Nigerian Stock Exchange All Share Index has so far returned a loss of 16% year to date and is likely to close in negative territory.

The reason for the poor performance of stocks is largely attributed to the lack of demand for Nigerian stocks by both foreign and local investors. While the former has become the demand driver for stocks over the last 5 years, most analysts consider local investment appetite as a sustainable way of keeping demand alive in the stock market.

Rise and fall: According to the NSE, over a 12–year period, domestic transactions decreased by 66.68% from N3.5 trillion in 2007 to N1.185 trillion in 2018, whilst foreign transactions increased by 97.88% from N616m to N1.219 trillion over the same period. In the last 6 years (before 2019), foreign investor–led transactions were about N6.1 trillion compared to N4 trillion for the previous 6 years. This compares to N6.1 trillion and N10.4 trillion respectively for local investor inflows. The Nigerian stock market has thus relied heavily on foreign investment portfolio inflows to maintain demand and drive up market values. But it wasn’t always this way.

Banking crisis: Everything changed in 2011 after former CBN Governor Sanusi Lamido Sanusi changed the capital control rules allowing foreign investors to repatriate their inflows whenever they wanted to, provided that they had a certificate of capital importation. It also coincided with a dark period for Nigerian banking, following the collapse of several Nigerian banks including the likes of Oceanic Bank and Intercontinental Bank.

Since then, how the stock market performs has been less of fundamentals but more of foreign investor appetite for Nigerian stocks. Whenever the US cut rates, foreign investor inflow finds its way into emerging markets like Nigeria. Sometimes, demand for Nigerian stocks wanes if investors perceive that the exchange rate is overvalued, calling for a devaluation.

Most recently, it has been a combination of waning emerging market appetite, disdain for Buharinomics and geopolitical battles between Europe and Brexit, US and China, etc. For Nigeria to get out of its reliance on foreign investor demand, it will have to revisit another dark period in the history of the stock market.

Margin Lending: The major reason why the local stock market attracted trillions in investment was margin lending. Back then, newly capitalized banks lent out billions of naira to investors in the form of margin lending, driving up market valuations exponentially. Unfortunately, lack of proper credit risk management, weak regulations, and insider trading meant that investors and banks would later lose billions of naira when the bubble burst.

However, margin lending remains the key to unlocking value in the stock market. With effective regulations, the right incentives and better credit risk management, tens of billions can be poured into the stock market.

The Nigerian financial landscape is a whole lot better than it was several years ago and has improved on many fronts. Today, via the Bank Verification Number initiative of the CBN, borrowers can easily be identified making it easier for lenders and regulators to profile chronic defaulters. Also, recently the CBN granted local banks approval to set off bank account of loan defaulters from any other bank accounts they own within the country. Credit rating agencies in Nigeria have also stepped up their operational capabilities by improving their database of bank debtors including their credit rating information.

Regulators like the CBN, SEC and the Nigerian Stock Exchange are also better informed and more abreast of market dynamics and investor idiosyncrasies, making them better prepared than they were over a decade ago. Whilst risks such as insider trading and market manipulation still exist, retail investors are now better informed. Sell-side stockbrokers offer incisive research reports and the media has richer content that can better guide rookie investors.

Why bring bank margin lending: The incentive to have a more robust stock market cannot be overemphasized. Between 2007 and 2019, Nigeria recorded less than a dozen major listings. Apart from the likes of Seplat, Transcorp Hotels, CWG, Airtel Africa, Notore Chemicals, MTN Nigeria most of the listings on the exchange have been from relatively smaller companies and have all failed to boost market participation.

A major incentive for companies looking to list on any stock exchange is their ability to raise capital at an attractive price. Investors also want a considerable level of liquidity for their investment, allowing them to buy and sell whenever they want. Without margin lending, bank retail, and corporate investor participation, the Nigerian Stock Market could continue in this lull for another decade.

A robust stock market also means more liquidity for the economy as businesses can aspire to expand beyond subsistence operations and involve more private and public capital. Companies that are currently lower leveraged can also raise equity to repay their loans improving the overall financial health of the economy. As we create larger and more ambitious corporations, more jobs are created and the economy grows.

Been saying this for years