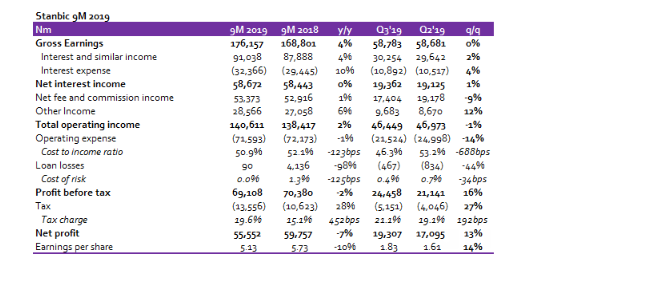

Stanbic IBTC 9M 2019 results showed a 4% y/y growth in Gross Earnings to N176.2 billion (annualised; N234.9 billion), slightly lower than our 2019 estimate on an annualised basis (CSL Forecast; N239.3 billion). Profit before Tax, however, declined 2% y/y to N69.1 billion (annualised; N92.2 billion), trailing our FY 2019 estimate of N94.7bn. On a q/q basis, Gross Earnings were flat at N58 billion while Profit before tax grew 16% q/q to N24.5 billion.

Interest Income grew marginally, up 4% y/y to N91.0 billion in 9M 2019 and 2% q/q to N30.3 billion. The growth in Interest Income was on the back of higher interest on loans and advances to customers (up 4% y/y to N48.5bn), reflecting the growth in the loan book (Net loans to customers grew 25% y/y as of 9M 2019). We highlight that the bulk of the expansion in the loan book came in Q3 (up 18% q/q). We believe the strong double-digit growth in the loan book was on the back of CBN’s guideline which mandated banks to maintain an LDR of 60% by September 2019. With the loan growth recorded in Q3, the bank’s loan book is up 24% YTD.

[READ MORE: Quick take: 9M earnings impressive despite weak Q3 performance]

Interest Expense was up 10% y/y to N32.4 billion in 9M2019 and 4% q/q to N10.9 billion. This increase in Interest Expense was driven by increase in other borrowings (new real sector support fund taken from the CBN, disbursement from Development Bank of Nigeria), as well as debt securities issued (Senior unsecured bond of N30 billion raised in December 2018). This caused Net Interest Income to remain flat, both on a y/y basis and q/q basis.

Non-Interest Income grew marginally, up 2% y/y to N81.9 billion but declined marginally by 3% q/q to N27.1 billion. The y/y growth was on the back of higher Trading Income (up 6% y/y) amidst the flattish growth in Net Fee and Commission Income (up 1% y/y). However, the quarterly decline was due to weaker Net Fee and Commission Income (down 9% q/q), on the back of lower Brokerage and financial advisory fees (down 67% q/q) in Q3.

The bank reported Net impairment write back on financial assets of N90m compared to N4.1 billion in 9M 2018. nOperating income grew modestly, up 2% y/y to N1140.6 billion but was flat in Q3.

Cost efficiencies remained firm as Operating Expenses declined 1% y/y to N71.6 billion and 14% q/q to N21.5 billion. The decline in OPEX coupled with marginal growth in Operating Income (+2% y/y) led to a 123bps improvement in Cost to Income Ratio (CIR ex provisions) to 50.9%.

Pre-tax Profit declined 2% y/y to N69.1bn, largely on account of reduced write back on financial assets (N90m in 9M 2019 vs N4.1 billion in 9M 2018). On a quarterly basis, Pre-tax Profit grew 16% q/q to N24.5 billion. Profit after tax declined 7% y/y to N55.6 billion, owing to higher effective tax rate of 19.6% in 9M 2019 compared to 15.1% in 9M 2018.

[READ ALSO: Inflation quickens to 4-month high of 11.24% on food, utilities]

Annualised RoAE stood at 27.4% in 9M 2019 compared to 38.9% in 9M 2018. We have a target price of N65.0/s for Stanbic (current price: N37.0) with a Buy recommendation. Our estimates are under review.

______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.