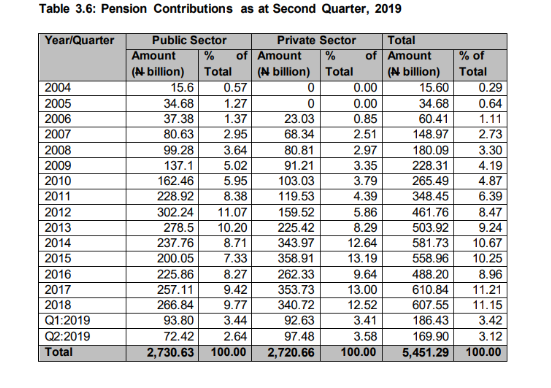

Pension contributions in Nigeria rose by N169.9 billion in the second quarter of 2019 to push the aggregate total contributions to N5.45 trillion. This is reflected in the National Pension Commission (PenCom) report for the second quarter of 2019.

According to the PenCom report, the aggregate pension contributions rose from N5.28 trillion in the first quarter to N5.45 trillion in the second quarter of 2019. This represents a 3.2% (N169.9 billion) growth in three months.

[READ MORE: PenCom bars PFAs from collecting bond’s brokerages fee]

Breakdown of pension contributions

Meanwhile, analysis of the pension contribution report shows pension contribution in the second quarter was lower than the contribution recorded in the previous quarter of the period under review.

- Specifically, in the first quarter, total pension contribution increased by N186.43 billion while the contribution in second-quarter increased by N169.9 billion.

- A closer look shows the decline in the total pension contribution was from the public sector.

- Accordingly, the public sector contribution dropped from N93.8 billion in the first quarter to N72.42 billion in the second quarter.

- On the other hand, contributions from the private sector rose from N92.6 billion in first quarter to N97.48 billion.

- As at the second quarter of 2019, the aggregate pension contributions of the private sector increased to N2.72 trillion while public sector increased to N2.73 trillion over the same period.

Pension Assets’ Class rose by N695.6 billion in eight months

While pension contribution rose in the second quarter, a look at PenCom August report shows Pension Fund Assets value in Nigeria rose by N695.6 billion in eight months.

According to the PenCom reports, Pension Fund Assets rose from N8.74 trillion in January 2019, to N9.43 trillion in August. This shows an increase of N695.6 billion and represents a 7.9% growth in nine months.

- Pension Fund Asset class includes FGN securities, Corporate Debt Securities, Local Money Market Securities and Mutual Funds.

- In August 2019, a larger chunk of the total Pension Fund remained in the Federal FGN Securities. According to the report, FGN securities constitute 72.24% or 6.81 trillion of the total asset fund.

- Basically, the FGN securities include FGN Bonds, Treasury Bills, Agency Bonds, Sukuk Bonds and Green Bonds.

- Also, investment in Local Money Market Securities (Banks and Commercial Papers) ranked second with the 11.21% of total asset fund. Essentially, the asset funds invested in local money market securities stood at N1.06 trillion.

- Investment in Corporate Debt Securities stood at N556.2 billion in August 2019, representing 5.89% of the total pension fund assets.

- Lastly, investment in Mutual funds only constituted less than 1% (N22.3 billion).

[READ ALSO: Pension asset increases to N9.33 trillion – PenCom]

Upshots

Since 2014, on an annual basis, the private sector has been the largest contributor to pension fund in Nigeria. This implies participation in the private sector is more than the public sector.

- Also, the 8.57 million pension contributors only represent 12% of the population of employed people in Nigeria.

- Concerns about the “conservative” investment strategy of pension fund administrators (PFA) who invest almost exclusively in FGN securities, still remains the major reason for the low rate of return.

- Although the rationale behind trying to preserve the pension fund has always been to invest in secured fixed income securities and this in the meantime is paying off.