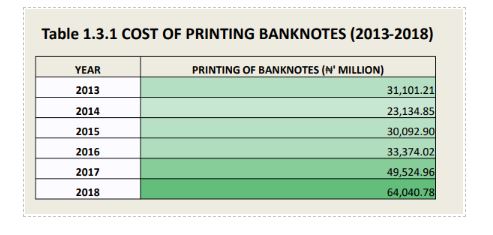

The Central Bank of Nigeria (CBN) spent a cumulative sum of N231.2 billion to print banknotes in the last 6 years (2013 – 2018). This was disclosed in the 2018 annual report released by the Central Bank’s Currency Operations Department.

According to the CBN report, between 2013 and 2018, the total cost incurred on printing banknotes increased by 105%. Specifically, the sum of N31.1 billion was spent in 2014 to print banknotes while it rose to N49.5 billion in 2018.

[READ MORE: Lenders increase unsecured loans to households in Q3 2019 – CBN]

Details provided by the CBN showed that the Nigerian Security Printing & Minting (NSPM) Plc remained the National printer of the Nigerian legal tender currency. According to the report, the company has an installed capacity to produce 4 billion pieces of banknotes per annum, with a production plan of 3.35 billion pieces of banknotes for 2018.

- However, the company produced 2.68 billion pieces of banknotes as at the end of 2018, compared with 1.97 billion during the same period in 2017.

- Analysis of the production plan of the company indicated an increase of 711.80 million pieces or 36.11%.

The total stock of currency (issuable and non-issuable) in the vaults of the bank as at the end of December 2018 stood at 1.71 trillion pieces, compared with 1,28 trillion pieces in 2017, indicating an increase of 33.83%.

- As at end-December 2018, the total issuable notes (newly printed notes and Counted Audited Clean notes) stood at 496.61 million pieces.

- Comparing with 256.61 million pieces in 2017, this indicates an increase of 240 million pieces or 94.0%.

- The CBN noted that the increase was attributed to the volume of new notes supplied by NSPM PLC.

Currency concerns: The currency department of the CBN stated that it was confronted with a number of operational challenges in 2018. According to the report, the challenges included the sale of newly minted Naira notes; poor handling habits of banknotes by the public; hoarding of the Naira and high cost of currency management.

Other constraints were rising incidences of counterfeiting of the higher denomination banknotes; public apathy in the usage of coins; disposal of banknotes waste in an eco-unfriendly manner, and banknotes inter-leafing and other shortages discovered in the deposits of DMBs and Bankers Warehouse.

[READ ALSO: CBN, this is one option that’s better than forex ban – Kalu Ajah]

Meanwhile, the CBN stated that to address challenges, it would sustain efforts to conduct operational research and benchmark best practices to improve Currency Operations Management. It also stated that the currency department would continue collaboration with security agencies to mitigate the sale of newly minted Naira banknotes, through sting operations and other activities.

My name khamis khuzaifa

My question here is

How much does CBN create every year