Hopes of trade talk reemerges

Although trade tension between the U.S and China persists, officials of the two countries have agreed to reopen trade talks in October. The possibility of a trade talk was welcomed by investors as gains were recorded in September across key market indices: Dow Jones Industrial Average (+1.55%), S&P 500 (+1.30%) and the Shanghai’s CSI 300 index (+0.38%).

Also, the attack on Saudi Arabia’s oil facility in September led to an initial surge in the price of Brent crude, however, Saudi Arabia recovered earlier than anticipated, restoring balance in the market as Brent oil prices only rose mildly by 0.58% in the month.

[READ MORE: Ajaokuta Steel capable of creating not less than 600,000 jobs – NIMMME boss]

In September, the FAO Food Price Index rose by 3.3% year-on-year but was unchanged on a month-on-month basis. The stability in food prices was as a result of the sharp decline in sugar prices offsetting the rise in prices of vegetable oil and meat.

In Nigeria, the naira remained relatively stable in the month, gaining 0.19% against the U.S dollar to close the September at NGN362.23/USD in the I&E window. Hence, external inflationary pressure was minimal in the month, informing our expectation of a marginal increase in core inflation.

Border closure pressures food prices

After signing the African Continental Free Trade Agreement (AfCFTA), the government initiated steps to address issues on dumping and smuggling. Land borders, which were closed in August, remained closed, pressuring food prices in the country.

Data gathered revealed a rise in the prices of food items, particularly imported food items. However, local producers of some staples have enjoyed the advantage of the supply gap as the prices of local substitutes rose in response to the shortage.

[READ ALSO: Border closure: Manufacturers lament losses incurred daily]

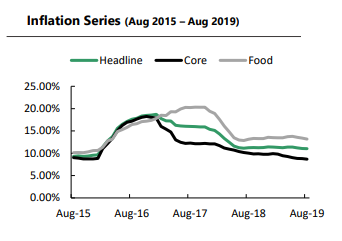

The Foreign exchange restriction on a couple of food items in prior months, further worsened the situation, resulting in a steep increase in food prices. Premised on the above, we expect a reversal of the downward trend in the food inflation index. Sequel to our evaluation of key inflation triggers in the economy, we expect the headline inflation to increase by 11.15% year-on-year.

Sequel to our evaluation of key inflation triggers in the economy, we expect the headline inflation to increase by 11.15% year-on-year.