The Federal Airports Authority of Nigeria (FAAN) has finally begun the rehabilitation of the runway at the Akanu Ibiam International Airport, Enugu.

The commencement was disclosed by Henrietta Yakubu, the General Manager, Corporate Affairs of Federal Airports Authority of Nigeria.

[READ MORE: 2020 Anambra Budget: N6 billion proposed for cargo airport construction]

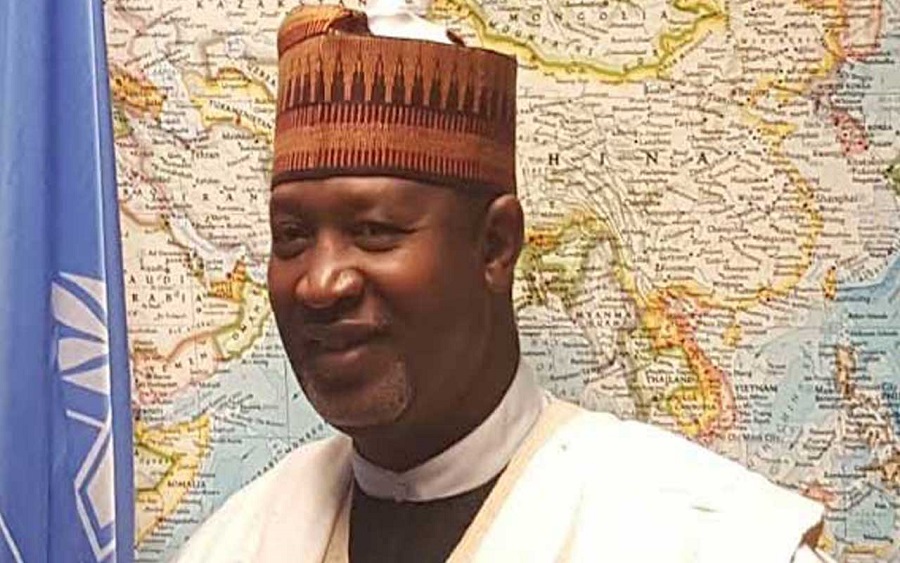

Yakubu made it known that the work had begun ahead of the December 2019 deadline set for the completion of the runway repairs and other renovation works which the Minister of Aviation, Hadi Sirika had earlier disclosed.

Recall that Nairametrics reported when FAAN announced the closure of the airport on August 24, 2019, until further notice. Several circumstances had led to the planned closure which was first hinted in May this year. The closure was said to have affected Ethiopian Airlines and Air Peace.

The announcement of the closure was no surprise as it came more than two months after Sirika, in May 2019, addressed the problems surrounding the Akanu Ibiam International Airport.

Prior to this development, international flights had been diverted to the Port Harcourt International Airport in Rivers by Ethiopian Airlines due to the closure of the airport. In the same vein, domestic flights were diverted to the Sam Mbwkwe Airport, Owerri, the Port Harcourt Airport and the Asaba Airport in Delta.

The Minister of Aviation had scheduled a meeting with South-East Governors assuring them that the Enugu airport would be reconstructed to meet the standard of the Abuja International Airport.

While giving reasons to why the closure was necessary to resolve the existing safety and security concerns to flight operations, Sirika had said, in May that the Airport had a bad runway and landing aids.

[READ ALSO: FAAN closes some sections of Lagos Airport, here is why]

Another issue he noted about the airport was the presence of a market nearby which attracts birds and the constant collision of the birds with aeroplanes. Also, the state radio mast was wrongly placed and was directly facing the runway.