Since the introduction of financial technology (fintech) firms to the Nigerian financial services ecosystem, the story has never been the same. These companies came with a special kind of innovation that has broken down many barriers and made a lot of things possible — specifically, financial inclusion. Thanks to these innovative companies, Olumide, who lives and works in Lagos, can now easily send money across to his unbanked mother in Alawaye village, Ekiti. In the same vein, he can also easily access a quick loan whenever he needs one, without having to stake the whole world as collateral.

The Fintechs versus banks narrative

Indeed, fintechs have been phenomenal so far. However, the stiff competition they brought along has caused discomfort for some of the original players in the space, albeit to the benefit of customers.

While some banks have been swift in responding to the “threat” posed by fintechs, the truth remains that these companies remain a source of threat. If not for anything, they keep attracting new customers every now and then; customers who would normally go to traditional banking halls to transact business. It is in light of this that Nairametrics has decided to highlight some of the fintechs, which banks should be wary of.

The basis for the ranking

Before we proceed with this, it is important to note that we used a number of parameters in our analysis. These include:

- Ease of registration

- Conditions of loan

- Cost of loan

- Innovation

- Customer experience

- Advertising/marketing

- Presence on social media

[READ: This is what OPay’s N10 food looks like]

It should be noted that each of the five loan platforms featured here are striving, in their various capacities, to use innovation to change the lending game. The conditions of loan are relatively considerate and the same can be said for the cost of loan. Comparatively, customer experience is fair, even as these companies are continuously using adverts to endear themselves to existing and new customers. They also use social media platforms to target their customers, seeing as the majority of their customers in the younger demographic are there.

Kwik Money

This is one of the best quick loan companies in Nigeria, and there are reasons to support this. Importantly, it is quite easy to access loans from Kwik Money. You do not even need to present documentation or collateral. Instead, all you need is your phone number which, by the way, must be connected to your bank account.

Kwik Money has a special innovation which can access and rate your credit score by simply using the phone number you provide upon registration. How it works is that the fintech’s automated system will access your financial records and use that to calculate how much you are eligible to borrow. You could be eligible to borrow anything between N500 and N500,000.

[READ: How to know when your debts have gone overboard]

In terms of the cost of loan, you will be required to pay back at an interest rate of 15% for a duration of 14 days, and 25% for a duration of thirty days. The interest rates are within the range collected by many other fintech loan platforms.

Kwik Money is relatively active on social media, though it could do more to increase the number of its followers, especially on Twitter and Facebook. The company can also put in more effort in terms of advertising and marketing in order to reach more customers.

Meanwhile, there have been concerns about privacy when using the Kwik Money platform. Customers interviewed in the course of compiling this report complained that the fact that vital customer information can be accessed through their phone numbers is rather problematic. One customer even recalled how his mother and a friend were contacted to help forewarn him to refund his loan. This is an issue for the customers because, as another customer noted, “what if I didn’t want my family and friends to know that I am borrowing money from Kwik money? The fact that they could even contact those people without my knowledge is an issue.”

2. Carbon (formerly Paylater)

Carbon is yet another quick loan fintech that is arguably giving banks headache. Much like Kwik Money, you could become eligible to borrow between N10,000 and N500,000. To access loans via this platform, you will be required to download the Carbon app and register. The platform caters to everyone: from students, to salary earners and business owners.

Carbon’s cost of loan is probably the best when compared to the other platforms herein ranked. This is because, the more money you borrow, the less interest rate you will be required to pay the company. However, before you can borrow a lot of money from Carbon, you must have successfully passed through various stages.

[READ: If this doesn’t encourage you to start investing today, nothing ever will]

According to the Carbon ladder, the starting point for any borrower is N10,000. This loan is for the duration of 15-30 days at an interest rate of 10%. You will then remain on this stage until you’ve successfully repaid your loans nine times, after which you become eligible to borrow N50,000 at an interest rate of 5%. This is for a duration of 1-3 months. The next stage will accord you the opportunity to borrow N100,000 at 4% interest rate, also, for a period of 1-3 months. However, before you can borrow N500,000 for a duration of 3-6 months at 2%, you will be required to present a list of documents including your letter of employment, a valid ID card, your bank statement, and more.

3. Zedvance

Zedvance offers assorted loan packages to salary earners, and business owners. If information available on their website is anything to go by, customers can borrow as much as N5million upon registration. Registration requires downloading the Zedvance app from Google Play. The company is present in three other major Nigerian cities besides Lagos – Abuja, Ibadan, and Port Harcourt.

This company’s cost of loan is fixed at a 5.4665% interest rate per any amount you borrow. This makes it one of the most reasonable and attractive interest rates currently being offered by a Nigerian loan fintech.

In terms of marketing/publicity, Zedvance is doing a considerably good job to endear itself to existing and potential customers. It has nearly three thousand followers on Twitter whom it regularly engages, with marketing contents.

4. Renmoney

Renmoney is one of the most popular and innovative loan fintechs in Nigeria today, though its terms of engagement may not be best out there. The company says that customers can get loans of up to N4 million for a duration of 12 months at an interest rate of 33.9%. Meanwhile, the company has a policy of collecting what it calls “management fees” of N35,700 which is collected alongside the interest. This does not sit well with some customers.

5. Aella Credit

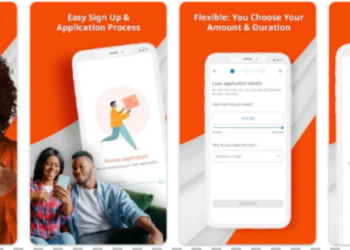

Much like the process for the other fintechs mentioned above, accessing loan from Aella Credit is reasonably easy. There are four basic steps – download the app, register, fill out an application, and receive your money. Based on their assessment, you could be qualified to receive N1,500 to N90,000 for a duration of one to two months. The interest rate varies from 4% to 29%, depending on the company’s metrics.

[READ: See the top ten Nigerian adverts in H1 2019]

In conclusion, it is important to mention that banks are already upping their games in the area of quick loans to customers. The activities of these fintechs have been a wake-up call for them to do better. Consequently, the likes of Guaranty Trust Bank Plc and Sterling Bank Plc are making considerable effort by offering reduced interest rates and efficient services.

Hi,

nice piece

Nice work from Emmanuel. Please can you also do a similar expose on saving and fixed deposit rates and terms of the fintech companies.

Good content.

Have you got the chance to check out Page Financials?

They have great service delivery in this space too, I am sure they are worthy of mention.

Sorry to say your information on carbon is miss leading carbon interest rate is 30% flat and that puts a borrower some kind of not so good business dealing