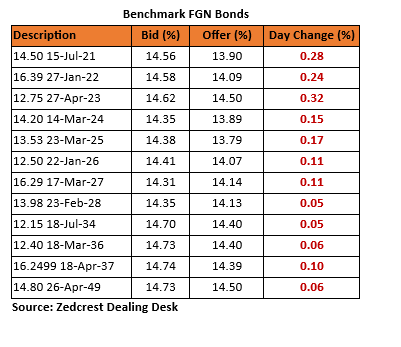

Bonds

The FGN Bond market opened the month on a firmly bearish note, with yields trending higher by c.14bps, as market players reacted to the hike in the 1yr OMO rate by the CBN to 13.50% (15.60% yield), which weakened bid prices further, especially on the short end of the curve.

We expect sentiments to remain weak within the bond market due to expectations for a further uptrend in short term rates.

[READ MORE: T-bill Yields Trend Higher as Offshore Selloff Persists]

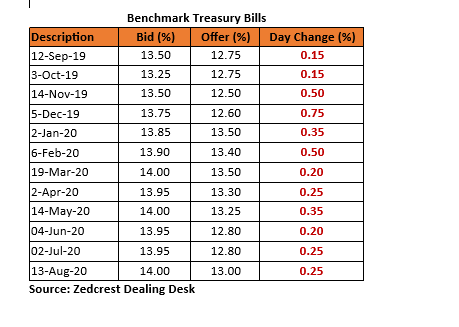

Treasury Bills

The T-bills market traded on a bearish note, with yields trending higher by c.30bps on the day. We witnessed the most selling interests on the Short end of the curve, following a further liquidity squeeze from a Wholesale FX sale by the CBN.

We expect yields to remain pressured across the curve, as market players anticipate a renewed OMO auction by the CBN later in the week.

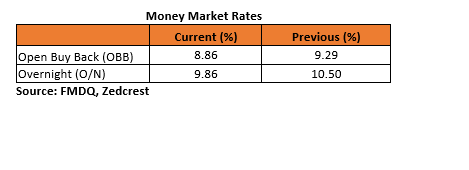

Money Market

Rates in the money market remained relatively stable as system liquidity was sustained in positive territory at c.N80bn est. The OBB and OVN rates consequently ended the session at 8.86% and 9.86% respectively.

We expect rates to remain relatively stable tomorrow, as there are no significant funding pressures anticipated.

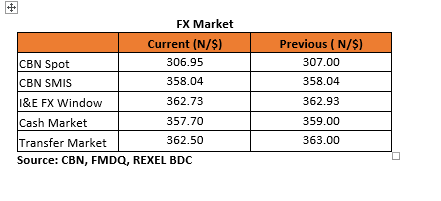

FX Market

At the interbank, the Naira/USD spot rate appreciated by 5k to N306.95/$, while the SMIS rate remained stable at N358.04/$. The Naira appreciated at the I&E window by 20k to close at N362.73/$. At the parallel market, the cash and transfer rates appreciated to N357.70/$ and N362.50/$ respectively.

[READ ALSO: Nigerian Eurobonds Dip Following Less Dovish US FED Stance]

Eurobonds

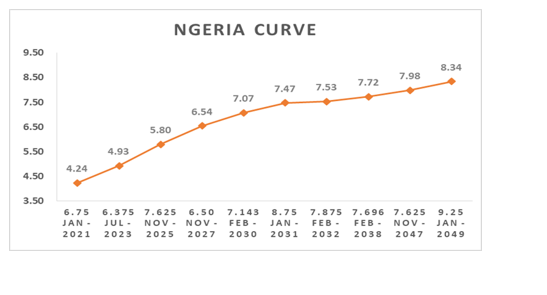

The NIGERIA Sovereigns traded on a relatively flat note, with yields marginally lower by 1bp on the day.

In the NIGERIA corps, we witnessed some buying interest in the UBANL 22 and ETINL 24.

________________________________________________________________________

Contact us:

Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment advice or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision